Balanced ETF portfolios DKK Q2 2021 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | 1.3% |

| Moderate-Defensive | 2.4% |

| Moderate | 3.3% |

| Aggressive | 4.2% |

| Aggressive-Growth | 5.1% |

Market overview

Q2 2021 began with the reopening of major economies, as COVID 19 vaccine rollouts continued to proceed at a healthy pace. The quarter also saw strong economic data releases and sizeable fiscal support, as governments in most developed markets eased COVID related mobility restrictions and activity levels picked up. In contrast, Emerging markets lagged against their developed counterparts as the Covid-19 crisis worsened in economies like India in April with case fatality ratios increasing significantly.

On the fiscal policy front, following the passage of the American Rescue Plan in March, President Biden outlined two more fiscal packages which propose a total spending of $4.1 trillion. This stimulus will be directed at the country’s infrastructure and a more equitable recovery. However, the central bank has become slightly more hawkish and has acknowledged that tapering is being discussed. The FOMC June rate-setting meeting resulted in no change in the policy, but it is expected to raise rates twice in 2023. On the economic front, US GDP grew at an annualized rate of 6.4% during Q1 wherein the growth in consumption was especially strong. Inflation as measured by the core consumer price index (CPI) rose from 3% to 3.8% year-on year in May, with the economic reopening being a big driver.

On the other side of the Atlantic, leading economic indicators have reached multi-year highs in many regions, pointing to strong economic rebound in Q2. The European Commission signed off on the first of the national recovery plans which will receive funding from the €800 billion Next Generation EU fund.

The UK saw a rise in COVID-19 cases in June, however this did not lead to significantly higher hospital admissions, suggesting efficacy of vaccines against the new Covid variant. On the monetary policy front, the BoE left interest rates and quantitative easing unchanged at the June meeting, however, the central bank acknowledged that inflation had been higher than expected.

Overall, equity markets ended the quarter on a positive note. Developed market equity (MSCI World Index) was up 6.4% in EUR terms. Emerging market equities (MSCI Emerging Markets Index) lagged developed markets and gained 3.5% in EUR terms.

Within fixed income, Government bonds saw mixed performance across the board, as U.S. treasury yields and UK 10-year yields fell over the quarter, while yields in the Euro-zone rose. Benchmark10-year U.S. treasury yields declined ending the quarter at 1.47%. The benchmark10-year Gilt yield fell from 0.85% to 0.72%, after a sharp rise in the previous quarter. Government bond yields of Eurozone economies such as Germany, France and Italy, on the other hand rose with increments in the range of 9-15bps.

The EUR ended at 1.19 against the dollar, up about 1.09% over the quarter, as market expectations for European growth improved on the back of healthy vaccination rates and falling hospitalizations.

Gold saw a modest gain over the quarter, finishing at $1770.1 per ounce, after seeing some volatility in June over the shift in interest rate expectations by the federal reserve.

Portfolio performance

| Returns net of fees | Defensive | Moderate Defensive | Moderate | Aggressive | Aggressive Growth |

| Apr | 0.1% | 0.5% | 0.9% | 1.3% | 1.6% |

| May | 0.1% | 0.2% | 0.3% | 0.4% | 0.5% |

| June | 1.1% | 1.7% | 2.1% | 2.5% | 2.9% |

| Since Inception (May 2016) | 14.6% | 22.2% | 32.2% | 40.0% | 45.5% |

In Q2 2021, reopening of major developed economies and strong vaccine rollouts was positive for global markets. As such all portfolios posted positive performance, with the higher risk profiles outperforming the lower risk profiles.

Within the equity sleeve, U.S. and European equities were the main contributors to performance while emerging markets were also additive and Asia-Pacific equities were flat over the quarter.

The fixed income sleeve was a modest contributor to overall performance. Inflation protected U.S. treasuries, long-dated U.S. treasuries (EUR hedged) and broad European government climate bonds were the main contributors to performance. However, core European Government Bonds were a detractor in the lower risk profile, as yields rose on

the back of improving growth and inflation expectations in most of the quarter.

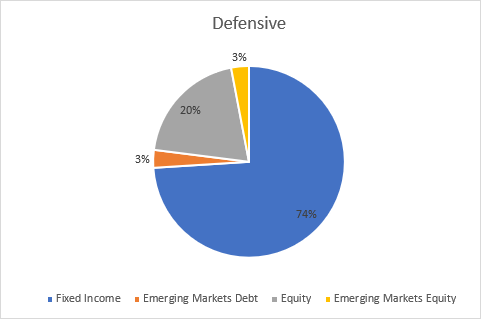

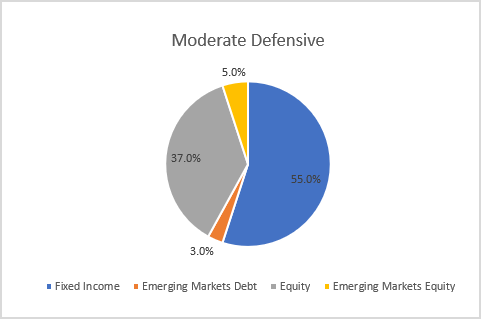

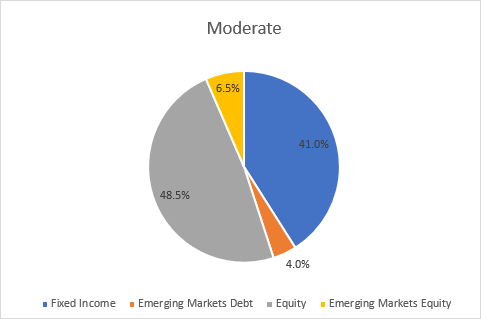

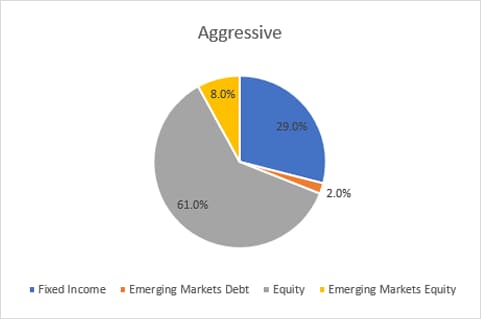

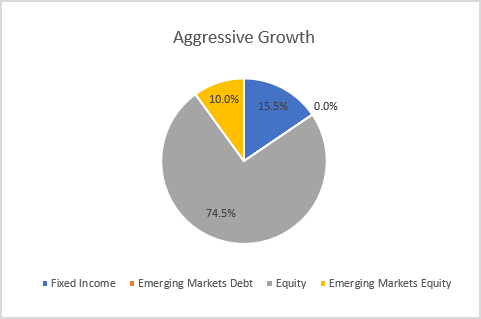

Portfolio Allocation and top portfolio holdings (as of June 2021)

Outlook

BlackRock team (the “team”) remains optimistic around equity market growth and adds to risk in the higher risk profiles whilst reducing duration across the range. The team also continues its efforts in ESG transition by adding ESG building blocks in the fixed income sleeve.

Within the equities sleeve, we add to EMU ESG enhanced equities in all the profiles except the Aggressive profiles, EM ESG equities in the Moderate, Aggressive and Aggressive Growth profiles. The team also added to Japanese ESG equities in the two higher risk profiles whilst reducing the same in the Defensive profile. Pacific ex-Japan equities was reduced across the range and US ESG equities in the lower three risk profiles. Finally, the team reduced US min vol equities (EUR hedged) in the Defensive, Aggressive and Aggressive Growth profiles whilst adding to the same in the Moderate Aggressive profiles.

Within the fixed income sleeve, the team added to US and European inflation linked bonds on the back of inflation concerns, whilst reducing long dated EUR hedged treasuries and European core government bonds across the range. ESG building blocks were added in the form of European Govt climate bonds to all the profiles except Aggressive Growth. Additionally, within the govt bond sleeve, the team reduced German government bonds, whilst adding to shorter duration European government bonds. Within the credit sleeve, European large cap bonds were reduced in the lower three risk profiles. Finally within EM, the team added to both EUR hedged and local currency EM bonds.