Balanced ETF portfolios USD Q2 2023 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

Quarterly return (net of fees)

| Defensive | -0.20% |

| Moderate | 2.89% |

| Aggressive | 3.85% |

Market overview

The second quarter of 2023 was characterised by significant divergence in the performance of financial assets. While news of persistent inflation, slowing growth and interest rates remaining higher for longer led to underperformance of safe-haven assets including government bonds, the excitement around Artificial Intelligence benefitted giant-cap Technology names which outperformed over the quarter.

Equity returns within the major U.S. indices were led by the enthusiasm and potential for artificial intelligence to boost economic growth. A small group of 8 giant-cap technology stocks accounted for the majority of returns within the NASDAQ and S&P 500, which both outperformed. A surprisingly solid economy, low interest rates and a weak currency within Japan drove the local market higher and resulted in Japanese Equities being among the top-performing assets of the quarter.

Emerging Market Equities broadly underperformed Developed Market peers but did close the quarter in positive territory. While continued geopolitical tensions and surprisingly weak manufacturing data out of China hurt performance, Equities within certain Latin American countries, including Mexico and Brazil, outperformed Developed Markets, counterbalancing the negative contribution to returns out of China.

Despite slowing growth, corporate balance sheets remained healthy, earnings resilient and default rates manageable, creating a favourable environment for riskier Fixed Income assets.

Performance within the Commodities space was mixed over the quarter. While several Soft Commodities produced double digit returns, Hard Commodities including Copper, Brent Crude Oil and Gold were challenged, in part, by slowing global growth and a weaker-than-expected demand recovery out of China.

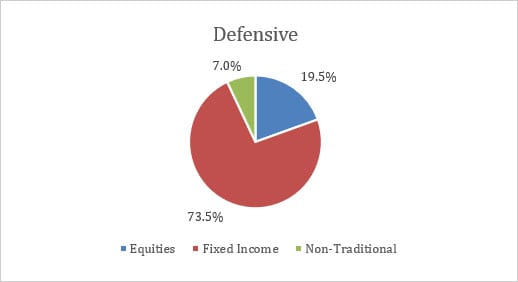

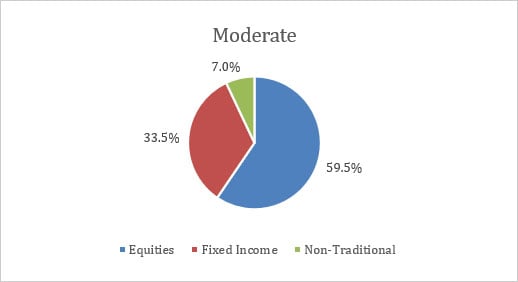

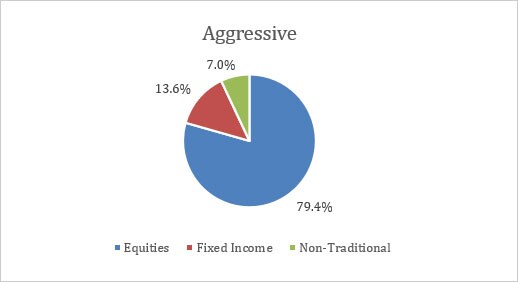

Portfolio Allocation (28/06/2023)

Performance

Over the quarter, the portfolios slightly underperformed the benchmark. Equity exposures were mostly additive and drove returns, both in June and during Q2. From a relative perspective, over the quarter, U.S. and Japanese exposures dragged active performance. Within fixed income, allocation to emerging market debt and floating rate bonds were amongst top contributors to return in Q2, while mortgage-backed securities and TIPS detracted. Long term treasury bonds also detracted over the quarter, but were additive in June as the Fed took a pause to policy tightening.

Latest rebalance rationale

During the latest rebalance, there was an increase in the portfolio’s equity exposures to capture the latest improving investor sentiment and earnings momentum.

Within equities, the U.S. allocation increased and at the same time this also reduced the underweight allocation to the technology sector at the portfolio level.

Japan’s economic recovery remains strong with inflation under control and there is an optimistic view on such developed markets. While earnings in Australia appear weak, there is a strong belief that the valuation of the region remains attractive. The strategy is now underweighting emerging markets as earnings have deteriorated and China’s recovery has shown signs of slowing.

Within alternatives, the latest rebalance trimmed the Treasury Inflation-Protected Securities (TIPS) exposure back to neutral. Living with higher inflation is still a possible scenario. For diversification purposes, allocations in GOLD and Real Estate Investment Trust (REITS) have not changed compared to the previous quarter.