Balanced ETF portfolios USD Q1 2022 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | -4.78% |

| Moderate | -4.12% |

| Aggressive | -4.28% |

Market overview

The first quarter of the year was a volatile one for financial markets. Russia’s invasion of Ukraine, the resulting exacerbated energy shock and rate hikes across many global central banks added significantly to investor uncertainty over the period. Supply-driven inflation and commodity prices surged following the sanctioning of Russia, with risk assets falling sharply before rebounding. Emerging markets were also weighed down by a new round of Omicron cases and broader geopolitical tensions. Developed market equities and emerging market counterparts declined steeply in a classic risk-off move over the period. Developed market equities (MSCI World Index) were down 5.53 percent, while emerging market equities (MSCI Emerging Markets Index) were down 14.7 percent over the quarter. Most global bond indices experienced a volatile period and finished the quarter down as rates continued to advance amidst upward trending inflation.

On the policy front, the US Federal Reserve (Fed) raised interest rates by 0.25 percent, in line with market expectations, with further rate hikes expected to rapidly reduce the size of the Fed’s balance sheet. Markets have priced in a further six increases for the remainder of the year, given record inflationary readings. Russia’s invasion of Ukraine has placed additional strain on food and energy prices, with inflation accelerating. The US labour market remained resilient over the period with the unemployment rate falling to 3.8 percent and average hourly earnings growing by 0.5 percent in February.

Within the European block annual inflation grew to an all-time high of 7.5 percent in March, driven by high food and energy prices; this was a significant increase from February. Following a €12 billion debt raising for its COVID-19 recovery fund, the European Union discussed the possibility of issuing bonds to finance energy and defence spending to alleviate sharply rising energy costs.

Sterling weakened against the US dollar from $1.35 to $1.31, while it was broadly flat versus the euro at €1.19. The dollar generally strengthened against major world currencies in Q1 2022, driven by a more risk-off tone to markets and by greatly heightened increases in expectations for interest rates in the US.

Major commodities, including energy and industrial materials, gained over the quarter. Gold prices rose meaningfully over the period on a flight to safety, alongside strong price rises for crude oil.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| Jan | -3% | -4.3% | -5% |

| Feb | -1.6% | -1.6% | -1.9% |

| Mar | -0.2% | 1.8% | 2.6% |

| Since inception (Feb 2017) | 17.17% | 38.52% | 53.55% |

The multi-asset portfolios produced negative absolute returns, but outperformed their respective index in Q1 2022. Within equities, the portfolios’ overweight in Canada contributed to relative performance as the country’s stock market was powered by the surge in commodity and energy prices. The portfolios’ underweight in emerging market equities was also additive to overall performance, while the overweight in US equities and real estate investment trusts (REITs) detracted.

Within fixed income, the portfolio benefited from the underweight in investment-grade bonds and emerging market debts. Overall, the duration underweight was additive. Elsewhere in fixed income, the overweight in high-yield bonds detracted from performance.

As global markets remained volatile, the portfolio’s gold exposures within the alternative sleeve contributed to performance.

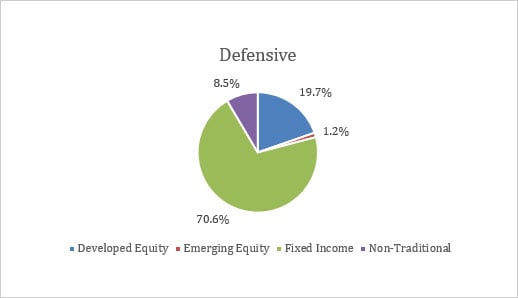

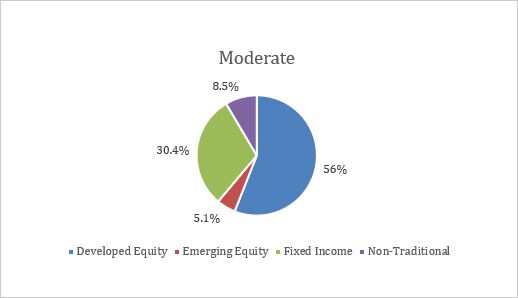

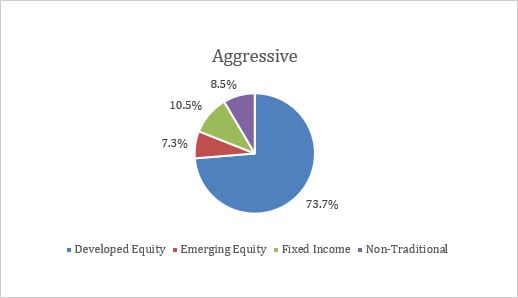

Portfolio allocation (as of 20th April 2022)