Balanced ETF portfolios USD Q3 2021 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | -0.2% |

| Moderate | -0.02% |

| Aggressive | -0.01% |

Market overview

The third quarter of the year was volatile for most financial markets. Whilst it started well, some gains were erased in September when global equities and fixed income assets retreated. Risk appetite deteriorated towards quarter-end due to a combination of risk factors such as potential monetary policy normalization, concerns over the rate of growth, supply disruptions and rising inflation. Nonetheless, there is currently limited evidence showing a derailed global recovery. Growth resilience and improving fundamentals have helped providing supports to equity markets year-to-date.

Developed market equity performance was generally positive over Q3 after a moderate correction in September. Emerging markets were down over the quarter, with attention remaining on China’s regulatory crackdown and the contagion effect of potential default of large property developers. Within emerging markets, there was a high level of dispersion across countries and sectors, partly driven by the differentiated pace of COVID-19 vaccination rollout and mobility restrictions implemented by government. The resurgence of the Delta variant does post a risk to countries with relatively low vaccination rates. On the other hand, Japanese equities rallied over the quarter amid decline in Covid cases and more certainty around the political front after the Prime Minister election.

On the fixed income side, financial markets saw a broad-based rise in yields towards the end of the quarter on the back of a hawkish pivot by key central banks around the globe. In the US, the Federal Reserves signaled their intention to slow the pace of asset purchases (potentially in November). Government bonds were pressured after their rally earlier in the quarter. Corporate spreads remained resilient, with high yield outperforming investment grade over the quarter.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| Jul | 0.8% | 0.8% | 0.9% |

| Aug | 0.7% | 1.7% | 2.1% |

| Sep | -1.7% | -2.5% | -3% |

| Since Inception (Feb 2017) | 21.1% | 38.56% | 52.13% |

The multi asset portfolios produce positive returns in Q3 and YTD Allocation to equities, notably developed markets, remained the key contributors to absolute performance YTD.

The fixed income allocations reflect the general market observations. YTD, in absolute terms, contributions were negative with an exception of high yield, floaters and interest rate hedged credit. The low duration position had helped limiting the downside as long-dated US treasuries remained the largest underperformer year-to-date.

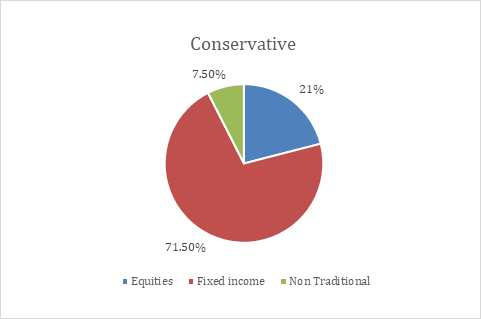

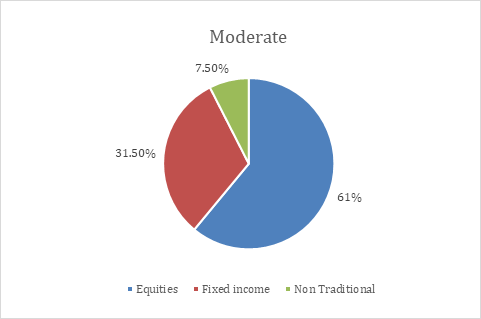

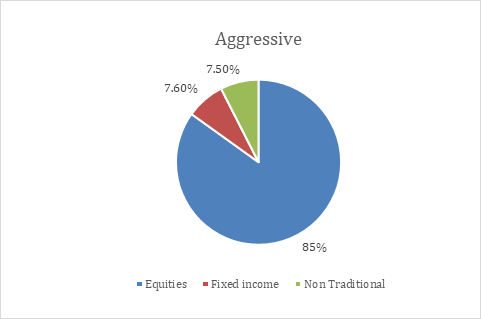

Portfolio Allocation and top portfolio holdings (end of Sept 2021)

Outlook

The turnover of this rebalance is low. Supply chain disruption and increasing demand driven by reopening pushed oil prices higher. Therefore, Canadian equities were added given the energy exposure in the country which would benefit from the higher energy price. As vaccination rate stay high in developed markets, it is expected that the region will continue to benefit from the broadening restart. The underweight in emerging market equities is kept. Growth expectations have been reduced and policy risk in China, coupled with a weak earnings season relative to the other regions. Within the fixed income sleeve, it was added the long end of US Treasury yield as the recent increase in yield has provided a good entry point to unwind some of the underweight positions.