Quarterly Outlook

Q1 Outlook for Traders: Five Big Questions and Three Grey Swans.

John J. Hardy

Global Head of Macro Strategy

Chief Investment Strategist

As we step into 2026, the conversation around AI is shifting. The question is no longer whether AI investment will continue—global capex plans, data-centre buildouts and electrification needs suggest it will—but how to participate without getting caught in the frothier corners of the market.

This is where fundamentals matter again. After a cycle dominated by narratives, 2026 is shaping up to reward balance-sheet strength, cash-flow visibility and the companies building the infrastructure that AI actually relies on, rather than those simply riding sentiment.

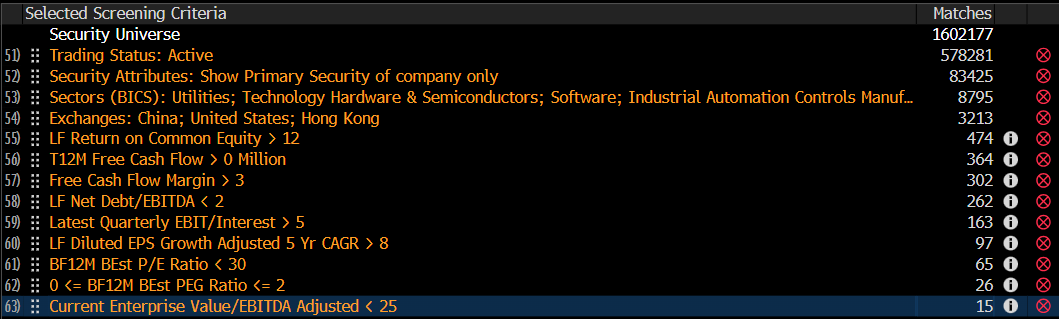

To explore this theme, we have built a simple Bloomberg framework that screens for AI-adjacent businesses with real earnings, real cash flow and reasonable valuations. This isn’t a stock list or a set of recommendations. It’s a framework to help investors recognise the financial signals, such as earnings quality, free cash flow and valuation discipline, that often differentiate real AI execution from noise.

AI is no longer a single-sector story. The buildout now spans chips and hardware, industrial automation, software, and even utilities powering data centres. To reflect this broader ecosystem, the screen focuses on four BICS segments that sit at the core of the AI economy:

These sectors represent the practical backbone of AI – compute, storage, automation and electrification.

But exposure alone isn’t enough. 2026 may be a year where dispersion widens within AI: some companies will compound, others may struggle to meet optimistic expectations. So the goal was to identify companies showing financial resilience alongside AI relevance.

Companies must meaningfully earn on the capital they deploy. This is a first line of defence against speculative growth stories.

Cash generation remains the cleanest signal of operational health, especially in capex-heavy AI ecosystems.

AI buildouts are expensive; heavily leveraged players may be vulnerable if funding costs rise again.

This avoids cyclical blow-ups and screens for companies with some track record of delivery.

These are not “cheap” companies - AI rarely is - but they are not priced for perfection either.

Taken together, these filters lean toward AI recipients rather than AI hopes—businesses with both the balance-sheet capacity and operational traction to benefit from the structural investment cycle.

Source: Bloomberg

Source: Bloomberg

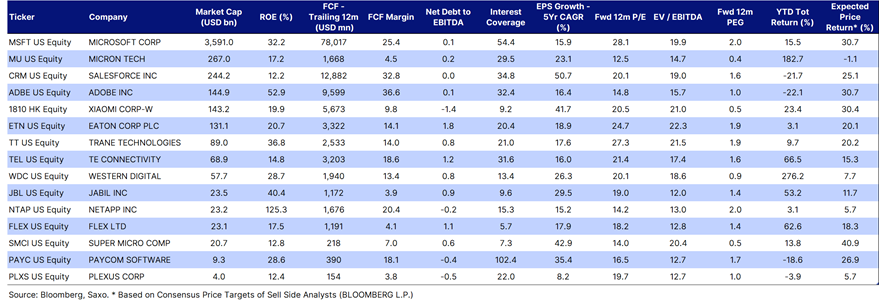

The screen narrowed over 1.6 million securities to just 15 names—a small, globally diversified mix spanning US, China, Hong Kong and Europe.

Where the capex bottlenecks are tightening. These companies sit at the heart of memory, compute platforms and advanced manufacturing—the plumbing beneath the AI boom.

Where AI adoption meets recurring revenue. These firms combine strong margins with sticky customer ecosystems, making them potential AI productivity beneficiaries

The overlooked winners of the AI physical buildout. Here the link to AI is indirect but powerful: data-centre cooling, thermal systems, interconnects and robotics.

This is a segment benefiting from the physical interface between consumers and AI services.

The future bottleneck of AI. AI’s biggest constraint is no longer algorithms – it’s electricity. Utilities and electrification specialists could play an increasingly central role.

The presence of both reinforces that the screen captures AI enablers with receipts, not hype cycles.

Three messages stand out:

The survivors are not just chipmakers or megacaps. Industrial automation, cooling, connectivity and power systems show up strongly—evidence that AI is becoming a real-world capex cycle.

Many companies with impressive AI narratives failed the screen purely on free cash flow or leverage. 2026 could reward delivery, not declarations.

Despite strong growth profiles, the median P/E of the group is below 20x and PEG around 1.3—suggesting growth at a reasonable price rather than runaway multiples.

This is not a call to buy any of these companies. Instead, the screen can help frame a few strategic questions for 2026:

2026 could be the year AI shifts from hype to hard economics. A screen like this is simply one way to focus on companies that appear better equipped, financially and operationally, to navigate that transition.

The risk of an AI bubble hasn’t gone away. But the opportunity set is broader, deeper and more industrial than the headlines imply. By filtering for profitability, cash generation and valuation sanity, this framework aims to show that AI exposure doesn’t have to mean speculation. It can also mean fundamental resilience.