Frequently asked questions

Q1: What are the financing terms and how do I find them?

When a trade is funded by a loan you will be charged a margin lending interest on the loaned amount.

The loan interest is payable from the day that the share purchase is settled. Loan interest will continue until the settlement day for the share sale.

The loan amount is calculated daily based on the net cash balance on each margin lending account (in different currencies) and charged on a monthly basis.

You can find the Margin Lending Interest Costs under Trading Conditions > Trading rates for a given instrument.

Furthermore, you will be able to find a breakdown of the charges to your account in the Margin Lending Interest Details report available within the platform.

Q2: What happens if I trade in another currency using margin lending?

When using margin lending all trades will be placed in your main account, unless you have an account in the currency of the instrument you are trading. If you trade in another currency than your account currency you will be charged a conversion fee. You can find more information about our currency conversion fee here.

Q3: What is Buying Power and how is it calculated?

Saxo allows a percentage of the investment in certain securities to be used as collateral to increase your buying power. Thus your buying power is a function of your available cash and the collateral value of your cash positions. The collateral value of a position depends on the rating of the individual instrument.

You can find the collateral value of eligible instruments under Trading Conditions > Instrument or in the Collateral column available in relevant places on the platforms.

Q4: What can I invest in using my Buying Power?

With a margin lending account, you can invest in a wide range of instruments such as Stocks, ETF, Bonds and more using your Buying Power.

Q5: How much can I borrow?

The total amount you can borrow depends on the securities you have invested in.

Each eligible security has a risk rating from 1 to 6 – with 6 being the highest risk – and there is a specific collateral value attached to each rating group.

Please note, the initial collateral value there is an additional 10% haircut. For example, a rating 1 stock, the initial collateral will be 63% of the market value of the position due to a haircut of 37% and the maintenance collateral is 70% of the market value of the position due to a haircut of 30%.

See below table for more details on Initial Margin requirement:

Risk Rating | 1 | 2 | 3 | 4 | 5 | 6 |

Collateral value haircut | 37% | 37% | 37% | 37% | 55% | NA |

Collateral value | 63% | 63% | 63% | 63% | 45% | NA |

Implied leverage | 2.7x | 2.7x | 2.7x | 2.7x | 1.82x | NA |

See below table for more details on Maintenance Margin requirement:

Risk Rating | 1 | 2 | 3 | 4 | 5 | 6 |

Collateral value haircut | 30% | 30% | 30% | 30% | 50% | NA |

Collateral value | 70% | 70% | 70% | 70% | 50% | NA |

Implied leverage | 3.3x | 3.3x | 3.3x | 3.3x | 2.0x | NA |

You can find the risk rating and associated collateral value of eligible instruments under Trading Conditions > Instrument or in the Collateral column available in relevant places on the platforms.

If you only hold positive cash balances on your margin lending account(s) there is no collateral value haircut, so the collateral value is equal to the full cash amount.

Q6: What happens if I exceed the loan limit?

Trading on a margin lending account includes the risk of a “margin call” if the if the net collateral value of your positions drops below the loan amount. On your margin lending account(s) you need to keep your margin & loan utilization below 100% to avoid a stop-out. When a stop-out is triggered the system will cancel all your open orders and place market orders to all positions held in your margin lending account(s).

You will start receiving alerts once your margin & loan utilization reaches 75% (or above) to make you aware that it might be time to consider your exposure.

Q7: Is it possible to withdraw more than my cash amount?

It is not possible to withdraw more than your available cash amount from your margin lending account(s). You will be able to find your available cash balance under the Account Details where you will also find additional information relevant to your margin lending account(s).

Q8: Is short selling supported?

Initially short-selling of stocks will not be possible through Saxo. We intend to make this possible in the future and we will make sure to inform you once we are ready.

Q9: Securities ownership?

You generally remain the owner of the securities held in your margin lending account(s), subject to any of your obligations or Saxo’s rights under the General Business Terms, Margin Lending Client Agreement and/or any other applicable terms and conditions.

Q10: What will happen to my sub-accounts once I have Margin Lending enabled and how does the margin collateral work between different currency accounts?

After your Margin Lending account is approved and opened with Saxo, it means all the sub-accounts (e.g. in different currencies) will also have the margin lending feature enabled.

For example, if your default currency is HKD and you also have accounts in AUD, EUR and USD. It means margin lending features will be enabled for all your HKD, AUD, EUR and USD accounts.

Your margin and loan utilization is calculated across all your sub-accounts, i.e. all the positions in any of your sub-accounts are all cross collateralized, subject to FX collateral haircuts, and the margin and loan utilisation percentage is presented at the top-level.

Q11: Can I have a non-margin lending enabled sub-account within the same login?

It is possible to disable select sub-account(s) from margin lending. This means that purchases on your non-margin lending enabled sub-account(s) can be done only to the extent there is sufficient cash, and the positions in the account(s) will not be used towards the calculation of the margin and loan utilization on your margin-lending accounts. Please ensure you have sufficient cash in your margin lending account to prevent margin call or stop out due to unavailability of the collateral in the sub-account(s).

You can raise a ticket via Contact Support in the Platform for this request.

Q12: What are the interest rates Saxo offers for all the currencies and how is the interest calculated across different currencies?

You can find the interest rates, which is a Saxo Offer Interest rate + mark up in the Margin Lending page https://www.home.saxo/en-hk/accounts/margin-lending and https://www.home.saxo/zh-hk/accounts/margin-lending.

For example, if you have HKD and USD enabled for margin lending. The interest rate for the HKD will apply if the balance in your HKD account goes negative. Same to USD, if the balance in your USD account goes negative, you will be charged with the USD interest rate.

Q13: I am an existing margin lending client and I subscribed to an eIPO. What happens if the allotment is more than my cash balance in the account that I used to subscribe to this IPO?

If you have been allotted more shares than what your cash balance can cover, we would (1) liquidate the additional shares that are allotted to you if you do not have sufficient collateral to cover the additional shares allotted or (2) allot the additional shares to your account if you have sufficient collateral to open or increase your loan balances.

Q14: What is changing from 4th March 2022?

Representation of your collateral utilization will change to “Margin & loan utilization” The following examples of before-and-after are for illustration purpose only:

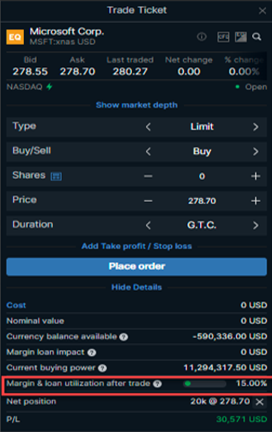

• Trade Ticket:

| Old setup | New setup |

|  |

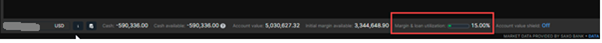

Account Summary (at the bottom of the trading platform):

Old setup

New setup

Q15: I have US$10,000 in my US$ margin lending account. If I buy US$10,000 of Apple Stock (63% initial margin, 70% maintenance margin), will I end up with a loan of $6,300 and a long cash balance of US$3,700”?

No, you will end up with no loan and a cash balance of NIL. All of the available cash in the currency of the share being purchased will be used up first. Only when there is no cash left will you enter into a loan with Saxo (upon which interest on the loan will be payable).

Q16: What interest do I get on my positive cash balances on my margin loan accounts?

There is no interest paid to you when your account balance is positive.

Q17: What is the difference between initial collateral and maintenance collateral?

Each stock in the margin lending universe has a collateral percentage associated with it. This percentage is applied to the market value of a stock to determine the collateral value of the stock.

The initial collateral percentage is always less than the maintenance collateral level to stop a client putting a position on and being immediately stopped out. As an example, a blue chip stock may have:

• Initial collateral percentage: 63%

• Maintenance collateral percentage: 70%

The collateral value of the stock, in turn, is an input into the margin and utilization calculation.

As the maintenance collateral percentage is higher, the collateral utilization will be lower than if the initial collateral percentage was used.

Saxo uses the initial collateral percentage to calculate how much leverage you can have and hence how much stock you can buy on margin. In the example, using the initial collateral percentage will limit the amount of stock you can buy on margin to an amount that will result in a margin and loan utilization of 90%. This is done so that it is impossible for a client to use maximum leverage, put a trade on, have a collateral utilization of 100% and then have the position closed out immediately.

Q18: Why is initial margin available smaller than maintenance collateral available?

Initial margin available uses the initial collateral percentage and maintenance margin available uses the maintenance collateral percentage. As the initial collateral percentage is always less than the maintenance collateral percentage, the initial collateral available will likewise always be smaller. Similarly the initial margin requirement on derivatives is higher than the maintenance further increasing the difference.

Once initial margin available is fully utilized, you will not be able to place any further trades in your margin lending account.

Q19: My margin and loan utilization is not 100% yet. Why am I unable to place any new margin trades?

You are unable to place new trades to increase exposure when the initial margin available is negative, however the margin and loan utilization is based on the maintenance margin levels required to maintain the positions.