Balanced ETF portfolios CHF Q4 2022 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | -0.37% |

| Moderate | 0.8% |

| Aggressive | 1% |

Market overview

After a short period of respite from market falls in October and November, December proved to be another disappointing month for asset returns. This rounded off an extremely challenging year across markets with equities posting their worst annual return since 2008, and global government bonds experiencing their first bear market in 70 years. Typically, government bonds provide a cushion to investors in uncertain environments. This did not prove to be the case in 2022, as higher and more persistent inflation led central banks to raise rates further than had been expected coming into the year. The resulting rise in yields across sovereign and credit markets led to the worst performance in a generation.

Commodity markets were one of the very few areas to generate positive returns over the year as the tragic war in Ukraine caused energy and food prices to rise. However, energy markets gave back some of these price gains in the final quarter of the year in response to signs of a much milder winter in Europe, in addition to measures that were introduced to reduce demand, thereby keeping gas storage levels relatively high. One of the main features of 2022 was the sizeable outperformance of ‘value’ oriented equity sectors relative to more interest rate-sensitive ‘growth’ sectors. This remained a theme over the final quarter in aggregate.

In addition to the negative impact of higher interest rates, growth stocks, particularly in the technology sector, had become increasingly expensive in terms of their valuations coming into 2022. Asian equities performed notably well in the final quarter, driven by some easing of COVID-19 control measures in China. The rebound in Asian equities late in the year was in sharp contrast to the moves seen in the preceding three quarters of the year, where these assets had been one of the most severe areas of decline.

Despite a weaker finish to the year, USD proved to be a bright spot for investors in 2022. It benefited from its traditional ‘safe haven’ status in addition to the rising rate environment in the US. In contrast, GBP declined over the course of the year, alongside UK government bonds, given investor risk aversion and the extreme levels of uncertainty created by the autumn ‘mini-budget’ proposals.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| October | 1% | 1.9% | 2.4% |

| November | 1.2% | 1.7% | 1.9% |

| December | -2,5% | -2.8% | -3.2% |

| Since inception (Aug 2016) | -1.5% | 10.67% | 20.61% |

The portfolios delivered positive performance over the quarter, with the higher-risk profiles outperforming the lower-risk profiles. Within the equities sleeve, European equities (CHF hedged) and Swiss dividend yielding equities were the main contributors to performance, followed by broad S&P 500 equities (CHF hedged). Emerging market and Asia-Pacific equities also contributed positively.

Within the fixed income sleeve, government bonds exhibited mixed performance. Emerging market debt contributed positively to performance, while US and Swiss government bonds detracted from performance. Within the credit sleeve, global high-yield bonds (CHF hedged) were top contributors. Finally, the contribution of the commodities sleeve was flat over the quarter.

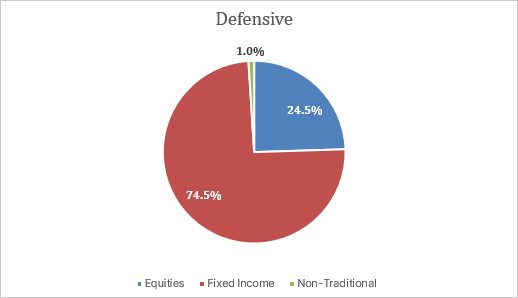

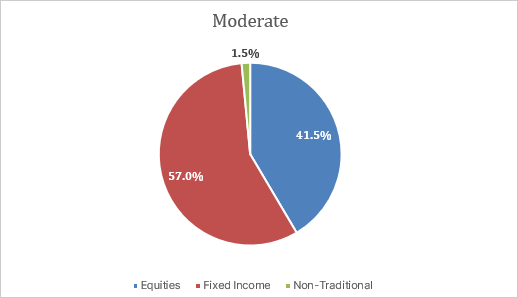

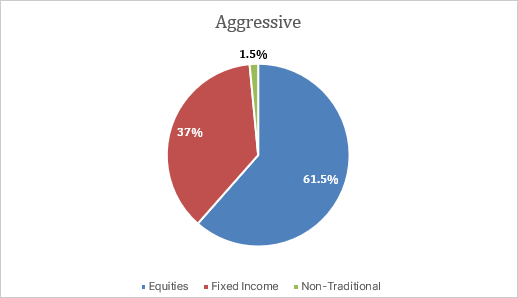

Portfolio allocation (as of 16 December 2022)