Balanced ETF portfolios CHF Q3 2022 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | -3.22% |

| Moderate | -3.24% |

| Aggressive | -3.39% |

Market overview

Globally, equities generally posted negative returns in Q3 2022. Developed markets struggled, with the US, UK and Europe recording negative performances. US markets initially focused on the possibility of interest rates cut from the Fed in 2023, but such hopes were dashed at August’s Jackson Hole summit, driving negative sentiment. UK markets experienced turmoil driven by Liz Truss’s appointment as prime minister and the UK’s fiscal package in September. Europe experienced further sharp falls in Q3 amid the ongoing energy crisis, rising inflation and subsequent fears about the outlook for economic growth. Japan posted positive returns in July and August, but followed global equity markets lower in September to end the quarter in negative territory. Other Asian equities were also weaker in the third quarter, with China as the weakest index. Emerging market equities also posted negative returns.

On the fixed income front, government bond yields rose, recording their highest levels in more than a decade. Sharper increases in gilt yields were driven by the events towards the end of September—the UK’s budgetary announcement accelerated the sell-off as investors questioned the UK’s fiscal stability. The Bank of England intervened by temporarily buying long-dated gilts, as it feared for financial stability. German yields also increased. Credit spreads widened across global markets, amid fears that tighter monetary policy may undermine further economic growth.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| July | 3.3% | 4.4% | 5.0% |

| August | -2.0% | -1.8% | -1.7% |

| September | -4.4% | -5.6% | -6.4% |

| Since inception (Aug 2016) | -3.8% | 6.2% | 14.5% |

Overall, the performance was negative over the quarter, as both equities and bonds detracted. Equities from both developed and emerging markets had a negative performance. Within fixed income, investment grade corporate bonds detracted least, while sovereign bonds from developed nations detracted most strongly from overall performance. Commodities acted as a diversifier in an otherwise challenging market environment.

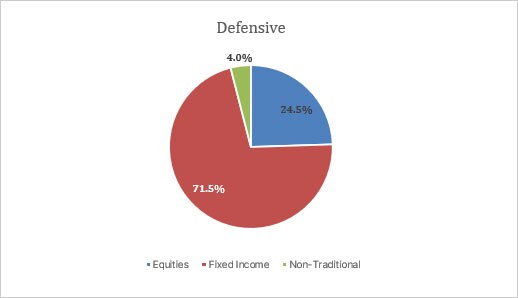

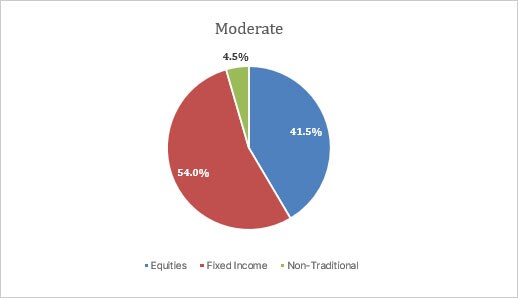

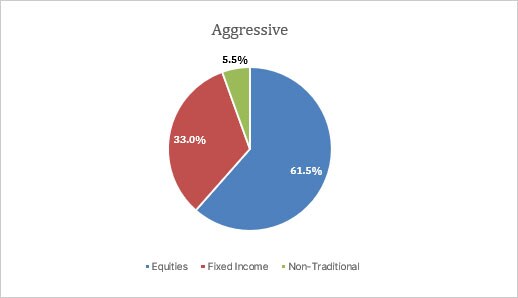

Portfolio allocation (as of 4th October 2022)