Balanced ETF portfolios CHF Q3 2021 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | -0.87% |

| Moderate | -0.82% |

| Aggressive | -0.86% |

Market overview

Q3 2021 began with continued global economic recovery, though a number of countries saw slowing recovery rates as the quarter progressed. The Covid-19 Delta variant continued to spread globally calling into question the sustainability of the economic momentum. Developed market equities, led by U.S. equities, started the quarter strong on the back of a strong earnings season. However, in September, financial markets saw heightened volatility owing to rising developed market government bond yields, in the context of rising inflation and concerns around and the continued disruption of global supply chains, which in combination brought the idea of stagflation into investors’ minds. Within emerging market equities, countries like India continued to perform well, whereas China was a dragon performance as concerns around the leveraged property sector as well as greater state control through tightened regulations in the tech and private education sectors, introduced further uncertainty.

On the monetary policy front, during the September U.S. Federal Reserve (Fed) meeting, the Chair reaffirmed a possible tapering in early November, which could be complete by mid-2022. The Chair made clear that the timing and pace of reduction in asset purchases will not be a signal for rate hikes since the conditions for raising rates are more stringent than those for tapering asset purchases. The European Central Bank (ECB) also announced a reduction in the pace of its asset purchases, but also stressed that this was not the beginning of a process of tapering purchases down to zero. As inflationary pressures continue to surpass expectations in the UK, the Bank of England (BoE) delivered the most hawkish shift, suggesting that it could raise interest rates before the end of the year. On the fiscal side, a US shut down was ultimately avoided for now and US democrats continued to make progress on their path to pass further stimulus packages.

On the macro front, the Consumer Price Index (CPI) in August was driven by declines in components that were initially strong throughout the summer such as used vehicles and air fares. US composite Purchasing Managers Index (PMI) showed slower upturns in manufacturing and service sectors. Amid supply concerns and rising demand across a world emerging from lockdown, global energy prices surged contributing to inflationary concerns. Amidst this backdrop, developed market equity (MSCI World Index) was up 2.5% in EUR terms over the quarter. Emerging market equities (MSCI Emerging Markets Index) lagged developed markets, down -7.0% in EUR terms. Within fixed income, towards the end of the quarter, 10-year government bonds finished in the red as yields rose across the board for major developed regions. Gold ended the quarter down -0.74% a$1761 per ounce, on the back of a stronger dollar and elevated treasury yields.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| Jul | 0.2% | 0.4% | 0.3% |

| Aug | 0.9% | 1.6% | 2.3% |

| Sept | -2% | -2.8% | -3.4% |

| Since Inception (Aug 2016) | 9.57% | 23.54% | 35.32% |

The performance of the portfolios was negative over the quarter. Within the equity sleeve, emerging market and European were a dragon performance while U.S. equities provided some relief by contributing to performance. The performance of the fixed income sleeve was negative over the quarter, with Swiss government bonds detracting the most from performance. The credit sleeve on the other hand, finished the quarter, flat.

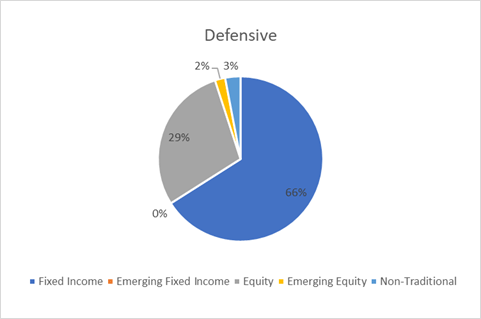

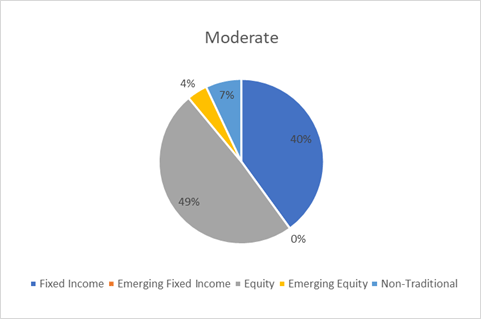

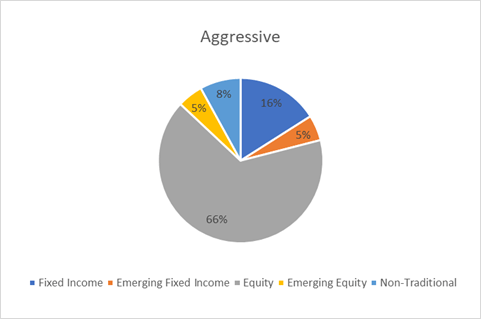

Portfolio Allocation and top portfolio holdings (as of Sept 2021)