Balanced ETF portfolios USD Q3 2022 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | -4.5% |

| Moderate | -4.4% |

| Aggressive | -4.6% |

Market overview

Heightened volatility continued during the quarter and most major markets remained in negative territory compared to last quarter and year-to-date. Global stock and bond markets observed a strong rally from mid-July to mid-August, but gave up all gains towards the end of the quarter. That decline was driven by a variety of reasons including more hawkish rate hike confirmations from central banks, disruptions to Europe's energy supply, and realisations that weaker growth, higher interest rates and persistent inflation will continue to unfold in the short to medium future.

Despite that short rally in July, global equities ended the quarter in negative territory, similar to performance in the quarter before. Developed equities outperformed their emerging market peers, but continued to be challenged by rising rates, inflationary US data, Europe’s ongoing energy crisis and sterling weakness. Emerging markets suffered from export growth slowdowns, low valuations and weak currencies.

Fixed-income markets also saw negative returns as yields continue to be pushed higher by unprecedently aggressive rate hikes. High yield and emerging market debt experienced lower drawdowns. Nonetheless, overall market sentiment was in risk-off mode amid global macro volatility and concerns over recessions.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| July | 2.7% | 4.6% | 5.3% |

| August | -2.5% | -2.5% | -2.6% |

| September | -4.7% | -6.2% | -7.0% |

| Since inception | 3.0% | 17.0% | 26.4% |

The multi-asset portfolios produced negative absolute returns in Q3 but outperformed their respective benchmarks in relative terms in the quarter as well as year-to-date.

In an environment where market volatility remained elevated, the portfolio’s ultrashort duration exposures continued to serve as an effective hedge against downside risk. Additionally, the position in floating rate bonds also contributed positively against a backdrop of persistent inflationary pressures which, in turn, led to aggressive rate hikes by central banks. Elsewhere in fixed income, the exposure to mid- to long-term treasuries hurt performance.

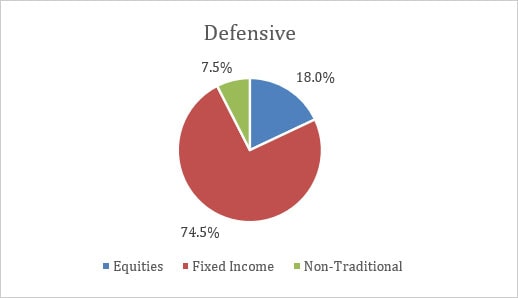

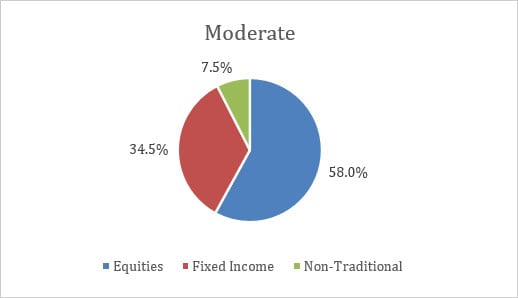

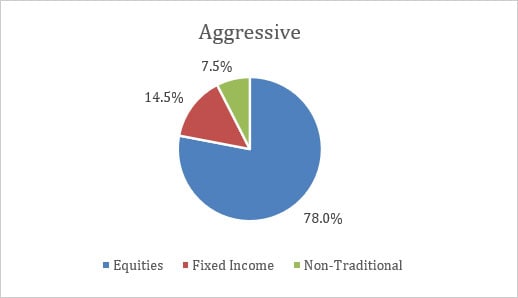

Portfolio allocation (as of 4th October 2022)