Actions

23 000+ actions sur 50+ places boursières mondiales.

La marge initiale et la marge de maintenance visent à vous protéger des conditions de marché défavorables en créant une marge de sécurité entre votre capacité de négociation et le niveau de liquidation pour cause de marge insuffisante.

Pour en savoir plus sur les marges initiales et les marges de maintenance, cliquez ici.

Pour trouver des informations sur les marges Forex, recherchez un instrument spécifique dans l'aperçu de la plateforme puis ouvrez l'aperçu du produit sélectionné. Sélectionnez le bouton d'information (i) en haut à droite, puis allez dans l'onglet Caractéristiques.

Le FX est un produit à effet de levier, ce qui signifie qu'il offre au trader la possibilité de contrôler de grandes quantités de capital en utilisant très peu d'argent. Plus l'effet de levier est élevé, plus le niveau de risque est élevé.

Les exigences de marge diffèrent d'une paire de devises à l'autre, et sont susceptibles d’être modifiées en fonction de la liquidité et de la volatilité sous-jacentes de la paire de devises. Pour cette raison, les paires de devises les plus liquides (appelées « majeures ») nécessitent, dans la plupart des cas, une exigence de marge inférieure.

Saxo Bank propose une méthodologie de marge échelonnée comme mécanisme de gestion des événements politiques et économiques susceptibles d'entraîner une volatilité et une évolution rapide du marché.

Pour de plus amples informations sur la méthodologie mentionnée ci-dessus, cliquez ici.

Vous trouverez la liste complète des exigences de marge par paire de devises sous Exigences de marge & Conditions de trading ainsi que sur les plateformes SaxoTrader, sous Conditions de trading.

Les exigences de marge peuvent être modifiées sans préavis. Saxo Banqk se réserve le droit d'augmenter les exigences de marge pour les positions de taille importante, y compris les portefeuilles de clients considérés comme étant à haut risque.

Si à tout moment alors qu'une position de change est ouverte, la marge requise pour maintenir cette position dépasse les fonds disponibles sur le compte, vous risquez un « stop-out ». Vous serez notifié lorsqu'un appel de marge survient et vous devrez réduire la taille des positions ouvertes et/ou déposer plus de fonds (couverture de marge) dans le compte. Si aucune mesure n'est prise, Saxo peut fermer tout ou une partie des positions ouvertes afin de réduire l'exposition à un niveau acceptable.

La marge initiale et la marge de maintenance visent à vous protéger des conditions de marché défavorables en créant une marge de sécurité entre votre capacité de négociation et le niveau de liquidation pour cause de marge insuffisante.

Découvrez plus d’informations sur les marges initiales et les marges de maintenance ici.

L’exigence de marge pour les options sur devises est calculée par paire de devises (assurant ainsi l'alignement avec le concept de marges par paliers selon le taux de change spot et à terme) et par date de maturité. Pour chaque paire de devises, il existe une limite supérieure à l'exigence de marge qui est l'exposition potentielle la plus élevée entre celle des options sur devises et des positions Forex au comptant et à terme, multipliée par la marge au comptant en vigueur. Ce calcul prend également en compte le netting potentiel entre les options sur devises et les positions Forex spot et à terme.

Dans le cas de stratégies à risque limité, comme par exemple un short call spread, l'exigence de marge sur un portefeuille d'options Forex est calculée comme étant la perte maximale à venir.

Pour les stratégies à risque illimité, par exemple les ventes de naked options, l'exigence de marge est calculée comme le montant notionnel multiplié par l'exigence de marge au comptant en vigueur.

Les taux de marge par paliers s'appliquent au calcul de la marge pour options sur devises lorsque la marge d'un client est déterminée par la marge de la position Forex spot en vigueur, et non par la perte future maximale. Les niveaux de marge pour le Forex spot en vigueur sont échelonnés en fonction des montants notionnels en dollars américains ; plus le montant notionnel est élevé, plus le taux de marge est susceptible d'être élevé. L'exigence de marge par paliers est calculée par paire de devises. Dans le calcul de la marge pour les options sur devises, l'exigence de marge spot en vigueur pour chaque paire de devises est le taux de marge par paliers, ou mixte, déterminé sur la base de l'exposition potentielle la plus élevée entre celle des options sur devises et des positions Forex spot et à terme.

Vous vendez un spread d'options d'achat sur 10M USDCAD aux taux de 1,41 et 1,42.

Le taux spot actuel est de 1,40.

L'exigence de marge sera la perte future maximale de 71 429 USD (10M x (1,42 - 1,41) = 100 000 CAD / USD @ 1,40).

Vous vendez une option de vente de 10M USDCAD. Vous courez un risque à la baisse illimité. L'exigence de marge est donc calculée comme le montant notionnel multiplié par l'exigence de marge spot en vigueur.

Le taux de marge au comptant en vigueur est déterminé par l'exposition potentielle la plus élevée, soit 10M USD.

Ainsi, le taux au comptant en vigueur est le taux de marge mixte de 2,2 % ((1 % x 3M USD + 2 % x 2M USD + 2 % x 2M USD + 3 % x 5M USD) / 10M).

L'exigence de marge est donc de 220 000 USD (2,2 % x 10M USD).

La marge initiale et la marge de maintenance visent à vous protéger des conditions de marché défavorables en créant une marge de sécurité entre votre capacité de négociation et le niveau de liquidation pour cause de marge insuffisante.

Découvrez plus d’informations sur les marges initiales et les marges de maintenance ici.

Les exigences de marge diffèrent en fonction des instruments et dépendent de l’exposition de ces derniers. Les exigences de marge peuvent être soumises à des seuils minimum réglementaires, et sont susceptibles d’être modifiées en fonction de la liquidité et de la volatilité sous-jacentes de l’instrument. Pour cette raison, les instruments les plus liquides nécessitent, dans la plupart des cas, une exigence de marge inférieure.

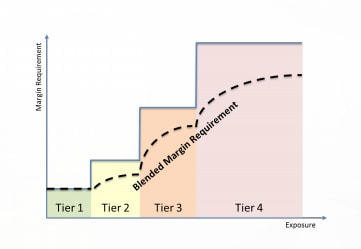

Saxo propose un système de marge par paliers afin de se prévenir des événements politiques et économiques susceptibles d'entraîner une volatilité et une évolution rapide du marché. Avec ce système de marge par paliers, plus le niveau d’exposition est élevé, plus l’exigence de marge moyenne (« exigence de marge mixte ») augmente. De même, plus le niveau d’exposition est faible, plus l’exigence de marge diminue. Voici une illustration de ce concept :

Les différents niveaux d’exposition (ou paliers) correspondent à un nombre absolu en dollars. Dollars (USD) sur tous les instruments. À chaque instrument correspond une exigence de marge spécifique par palier.

Les exigences de marge peuvent être modifiées sans préavis. Saxo se réserve le droit d'augmenter les exigences de marge pour les positions de taille importante, y compris les portefeuilles de clients considérés comme présentant un risque élevé.

La marge initiale et la marge de maintien sont conçues pour vous protéger contre des conditions de marché défavorables, en créant un tampon entre votre capacité de négociation et le niveau de clôture de la marge.

La marge initiale et la marge de maintien d'un CFD sur action individuelle sont basées sur la notation de l'action. Saxo définit 6 notations d'actions différentes. Cette note est dérivée de la capitalisation boursière, de la liquidité et de la volatilité de l'actif sous-jacent.

| Notation Saxo | Marge initiale | Marge de maintien |

|---|---|---|

| 1 | 6% | 5% |

| 2 | 11% | 10% |

| 3 | 17.5% | 15% |

| 4 | 30% | 25% |

| 5 | 50% | 45% |

| 6 | 110% | 100% |

Pour trouver la notation et la valeur de garantie, recherchez un instrument spécifique dans l'aperçu de la plateforme puis ouvrez l'aperçu du produit sélectionné. Sélectionnez le bouton d'information (i) en haut à droite, puis allez dans l'onglet Instrument.

| Tracker indiciel | Marge initiale | Marge de maintenance | |

|---|---|---|---|

| US 30 Wall Street | 1.50 % | 1.00 % | |

| US 500 | 1.50 % | 1.00 % | |

| US Tech 100 NAS | 1.50 % | 1.00 % |

| Denmark 25 | 4.00% | 3.50% | |

| EU Stocks 50 | 1.50% | 1.00% | |

| France 40 | 4.00% | 3.50% | |

| Germany 40 | 1.50% | 1.00% | |

| Germany Mid-Cap 50 | 4.00% | 3.50% | |

| Germany Tech 30 | 4.00% | 3.50% | |

| Netherlands 25 | 4.00% | 3.50% | |

| Norway 25 | 5.00% | 4.50% | |

| Spain 35 | 4.00% | 3.50% | |

| Sweden 30 | 4.00% | 3.50% | |

| Switzerland 20 | 4.00% | 3.50% |

| Australia 200 | 1.50% | 1.00 % | |

| Hong Kong | 5.00% | 4.00 % |

| Tracker indiciel | Marge initiale | Marge de maintenance | |

|---|---|---|---|

| China 50 | 10.00 % | 9.00 % | |

| UK 100 | 3.00 % | 2.50 % | |

| UK Mid 250 | 6.00 % | 5.00 % | |

| Singapore | 10.00 % | 9.00 % | |

| Taiwan | 10.00 % | 9.00 % | |

| US2000 | 8.00 % | 7.50 % | |

| Japan 225 | 5.00 % | 4.50 % | |

Découvrez plus d’informations sur les marges initiales et les marges de maintenance ici.

| Nom de l'instrument | Symbole | Marge initiale | Marge de maintenance |

|---|---|---|---|

MÉTAUX | |||

| Or | OR | 5 % | 2,50 % |

| Argent | ARGENT | 10 % | 5 % |

| Platinum | PLATINUM | 10 % | 5 % |

| Palladium | PALLADIUM | 10 % | 9 % |

| Cuivre | CUIVRE | 8 % | 7,50 % |

ÉNERGIE | |||

| Pétrole brut É.U. | PÉTROLE É.U. | 12,50 % | 10 % |

| Pétrole brut UK | PÉTROLE UK | 12,50 % | 10 % |

| Fioul | FIOUL | 12,50 % | 10 % |

| Essence É.U. | ESSENCE É.U. | 12,50 % | 10 % |

| Gasoil | GasoilUK | 12,50 % | 10 % |

| Gaz naturel É.U. | GAZ NATUREL | 17,50 % | 15 % |

| Émissions CO2 | ÉMISSIONS | 10 % | 5 % |

AGRICULTURE | |||

| Maïs | MAÏS | 8 % | 7,50 % |

| Blé | BLÉ | 8 % | 7,50 % |

| Soja | SOJA | 8 % | 7,50 % |

DENRÉES AGROALIMENTAIRES | |||

| Sucre NY n° 11 | SUCRE NY | 10 % | 5 % |

| Café NY | CAFÉ | 10 % | 5 % |

| Cacao NY | CACAO | 16,50 % | 15 % |

VIANDES | |||

| Bétail | BÉTAIL | 10 % | 5 % |

Découvrez plus d’informations sur les marges initiales et les marges de maintenance ici.

| Produit/Instrument | Marge initiale | Marge de maintenance |

|---|---|---|

| Emprunts d'État allemands à 5 ans Bobl | 2,5 % | 2 % |

| Emprunts d'État allemands à 2 ans Schatz | 1,5 % | 1 % |

| Emprunts d'État allemands à 10 ans Bund | 4 % | 3,5 % |

| Emprunts d'État français à 10 ans OAT | 5 % | 4,5 % |

| Emprunts d'État italiens à 10 ans BTP | 5 % | 4,5 % |

Découvrez plus d’informations sur les marges initiales et les marges de maintenance ici.

La marge initiale et la marge de maintenance visent à vous protéger des conditions de marché défavorables en créant une marge de sécurité entre votre capacité de négociation et le niveau de liquidation pour cause de marge insuffisante.

Pour en savoir plus sur les marges initiales et les marges de maintenance, cliquez ici.

Saxo opère avec deux profils de marge des clients liés à la négociation d'options listées1:

Le client est configuré sur le profil de base par défaut, et n'est donc pas en mesure de vendre des options listées. La vente d'options listées nécessite que le client remplisse les conditions suivantes, afin d'activer le profil avancé.

| Stratégie | Marge initiale et marge de maintenance |

|---|---|

Long Straddle | Aucun |

| Options d’achat à découvert hors de la monnaie | Options sur actionsPrix du call + Maximum((X %* Prix du sous-jacent) – Montant hors de la monnaie), (Y % * Prix du sous-jacent)) Le montant hors de la monnaie correspond, dans le cas d’un Call au : Max (0, Prix Strike de l’option – Prix du produit sous-jacent) Exemple : Short 1 DTE jan14 12,50 Call à 0,08 Prix du sous-jacent à 12.30

|

| Vente d’option à découvert | Options sur actionsPrix du Put + Maximum((X %* Prix du sous-jacent) – Montant hors de la monnaie), (Y % * Prix strike)) Exemple : short 1 DTE jan14 12 Put à 0,06 Prix du sous-jacent à 12.30

|

| Stratégie Bull Call Spread | Maximum ((Prix d’exercice de l’achat d’un call – Prix d’exercice de la vente à découvert d’un call), 0) Exemple : Achat DTE Jan14 12,5 Call à 0,10 et vente à découvert DTE Jan14 13,5 Call à 0,02

|

Bull Put Spread | (Prix d’exercice de la vente à découvert du Put - Prix d’exercice de l’achat du Put) – (Prix de la vente à découvert du putPut – Prix d’achat du Put) Exemple : Vente à découvert DTE Jan14 Put 12 Put à 0,08 et achat DTE Jan14 11 Put à 0,02

|

Short straddle | Si la marge initiale du short put > Marge initiale du short call, alors |

Les positions sur des options short de style américain peuvent être associées avec des positions longues sur options ou des positions de couverture sur le produit sous-jacent afin de réduire le risque d’exposition. Par conséquent, les exigences de marge peuvent être réduites ou même annulées. Nous proposons des réductions de marge pour les stratégies combinées ci-dessous :

Une position short sur un call peut être compensée par une position longue sur l’action sous-jacente.

Une position sur un spread permet à la position « longue sur option » de couvrir une position courte sur une option du même type et du même sous-jacent. Quand la position longue est plus loin dans la monnaie comparée à la position short (« debit spread »), la valeur de l’option longue est utilisée pour couvrir la valeur de l’option short sans marge additionnelle requise.

Quand la position short est plus loin dans la monnaie comparée à la position longue (credit spread), la valeur totale de l’option longue est utilisée comme couverture à laquelle s’ajoute une marge additionnelle équivalente à la différence entre les deux strikes.

Remarque : Pour clôturer une position sur un spread, il est recommandé de clôturer en priorité la ligne short afin d’éviter de subir une augmentation de marge liée à la position short d’option. Cependant, le client peut se retrouver dans une situation où il ne détient pas les liquidités nécessaires pour racheter la position short en raison notamment du système d’exigence de marge. Dans ce cas, le client se trouvera dans l’obligation de créditer son compte afin de clôturer la position.

Les positions short straddle / strangle fonctionnent de manière différente comparé aux positions sur des Covered call ou des Spread car les jambes du short straddle ne se compensent pas entre elles. Un short straddle / strangle combine un short call avec un short put. L’exposition du short call et du short put étant opposée, seule la marge additionnelle de la jambe nécessitant le plus de marge sera requise.

Lorsque la position call du strangle est assignée, le client se doit de livrer l’action sous-jacente. À l’inverse, lorsque la position put est assignée, le client se verra livrer l’action sous-jacente. La position longue sur action peut être combinée à la position call restante du strangle originel permettant d’obtenir un covered call.

Pour certains instruments, y compris les options sur actions, nous requérons une marge afin de couvrir les pertes potentielles qu’implique la détention de la position sur cet instrument. Les options sur actions sont traitées comme des « full premium style options ».

Lors de l’achat d’une position long sur une option dite « full premium », le montant de la prime est déduit du solde de compte du client. La valeur d’une position longue sur option ne sera pas disponible comme collatéral pour les opérations sur marge sauf exception décrite dans le paragraphe Réduction de marges.

Dans l’exemple suivant, le client achète un call Apple Inc. DEC 2013 530 à 25 $ (l’action Apple Inc. se traite à 529,85 $. Une option est égale à 100 actions, les commissions s’élèvent à 6,00 $ par lot et les frais de change s’élèvent à 0,30 $. Avec un solde de compte à 10 000,00 $, le relevé de compte se présenterait de la manière suivante :

| État des liquidités et des Positions | ||

|---|---|---|

| Valeur des Positions | 1 * 25 * 100 actions = | 2 500,00 $ |

| Profit/perte non réalisé | -- | |

| Frais de clôture | - 1* (6 $ + 0,30 $) = | - 6,30 $ |

| Valeur des positions non réalisée | 2 493,70 $ | |

| Solde | 10 000,00 $ | |

| Transactions non comptabilisées | - (2 500 $ + 6,30 $) = | - 2 506,30 $ |

| Valeur du compte | 9 987,40 $ | |

| Non disponible pour la couverture de marge | - 1 * 25 * 100 actions = | - 2 500,00 $ |

| Utilité pour les exigences de marge | -- | |

| Disponible pour trading sur marge | 7 487,40 $ | |

Dans le cas d’une option dite « full premium », les transactions non comptabilisées seront ajoutées au solde du compte du client lors de la comptabilisation. Le jour d’après, lorsque le marché options aura évolué à 41 $ (spot à 556,50), le relevé de compte se présentera de la manière suivante :

| État des liquidités et des Positions | ||

|---|---|---|

| Valeur des Positions | - 1 * 41 * 100 actions = | 4 100,00 $ |

| Profit/perte non réalisé | -- | |

| Frais de clôture | - 1*(6 $+0,30 $) = | -6,30 $ |

| Valeur des positions non réalisée | 4 093,70 $ | |

| Solde | 7 493,70 $ | |

| Transactions non comptabilisées | -- | |

| Valeur du compte | 11 587,40 $ | |

| Non disponible pour la couverture de marge | - 1 * 41 * 100 actions = | -4 100,00 $ |

| Utilité pour les exigences de marge | -- | |

| Disponible pour trading sur marge | 7 487,40 $ | |

Valeur des positions : La valeur a augmenté en raison de la hausse du prix de l’option.

Valeur des positions non réalisée : La valeur a augmenté en raison de la hausse du prix de l’option.

Solde : Réduction de la valeur en raison du prix d’achat de l’option qui a été comptabilisé. La ligne Transactions non comptabilisées est désormais à 0.

Valeur du compte : La valeur a augmenté en raison de la hausse du prix de l’option.

Non disponible pour la couverture de marge : La valeur a augmenté en raison de la nouvelle valeur de la position.

Dans le cas d’une position short sur option, l’investisseur peut être assigné à livrer le sous-jacent si l’autre acteur du marché détenant une position long exerce son droit d’option. Les pertes sur une position short option peuvent être considérables lorsque le marché n’évolue pas dans le bon sens. Ainsi, nous immobiliserons sur le compte du client une « marge de la prime » pour s’assurer que les fonds nécessaires seront disponibles afin de clôturer la position short ainsi qu’une « marge supplémentaire » pour couvrir d’éventuels décalages en overnight du sous-jacent. Le montant de la marge est actualisé en temps réel et une procédure de stop out peut être lancée lorsque la marge totale requise sur toutes les positions nécessitant de la marge dépasse le niveau autorisé du client.

La formule générique pour le calcul de la marge sur les positions short option est la suivante :

La « marge de la prime » permet de garantir que la position short option peut être clôturée au prix du marché et est égale au prix Ask auquel l’option peut être acquise durant les horaires de trading. La « marge supplémentaire » permet de couvrir les évolutions de prix du sous-jacent pendant la nuit lorsque l’option ne peut être clôturée en raison des horaires de trading.

Options sur actions

Pour les options sur actions, la « marge supplémentaire » est égale à un pourcentage de la valeur du sous-jacent moins le montant hors de la monnaie.

Les pourcentages de marge sont fixés par Saxo et peuvent être amenés à évoluer. Les valeurs réelles peuvent varier par contrat d'option et sont configurables dans les profils de marge. Les clients peuvent consulter les taux appliqués dans les conditions de trading du contrat.

Le montant hors de la monnaie pour un call est égal à :

Le montant hors de la monnaie pour un put est égal à :

Pour obtenir les montants réels, les valeurs obtenues doivent être multipliées par la quotité (100 actions).

Exemple :Supposons que l’équipe du risque applique un montant X de marge de 15 % et un montant Y de marge de 10 % sur Apple.

Un client décide de vendre un Call Apple DEC 2013 535 à 1,90 $ (l’action Apple stock vaut 523,74). La quotité de l’option est de 100 actions. Le montant OTM est de 11,26 points (535 – 523,74), ce qui équivaut à une marge supplémentaire de 67,30 points (6 730 $). Dans le relevé de compte, la « marge de la prime » est retirée de la valeur de position :

| État des liquidités et des Positions | ||

|---|---|---|

| Valeur des Positions | - 1 * 1.90 * 100 actions = | - 190,00 $ |

| Profit/perte non réalisé | -- | |

| Frais de clôture | - (6 + 0,30 $) = | - 6,30 $ |

| Valeur des positions non réalisée | - 196,30 $ | |

| Solde | 10 000,00 $ | |

| Transactions non comptabilisées | 190 $ - (6 $ + 0,30 $) = | 183,70 $ |

| Valeur du compte | 9 987,40 $ | |

| Non disponible pour la couverture de marge | -- | |

| Utilité pour les exigences de marge | - 100 actions *( (0,15 * 523,74) – 11,26) | - 6 730,00 $ |

| Disponible pour trading sur marge | 3 257,40 $ | |

Le vendeur de l'option est tenu de vendre (dans le cas d'une option d'achat) ou d'acheter (dans le cas d'une option de vente) l'instrument sous-jacent à (ou auprès de) l'acheteur de l'option au prix spécifié sur demande des acheteurs.

Une position d’option à découvert peut entraîner des pertes considérables lorsque le marché n’évolue pas dans le bon sens. Saxo exige une prime pour s'assurer que le compte client dispose de fonds suffisants pour clôturer la position d'option à découvert, ainsi qu'une marge supplémentaire pour couvrir toute fluctuation de prix de l'instrument sous-jacent qui aurait lieu overnight.

La formule générique pour le calcul de la marge sur les positions short option est la suivante : Marge Short Option = Marge de la prime + Marge supplémentaire.

L'exigence de marge est surveillée en temps réel. Si les pertes du client dépassent l'utilisation de marge, une liquidation automatique pour cause de marge insuffisante peut se produire, ce qui signifie que Saxo cherchera annuler et clôturer immédiatement tout ou partie des position ouverte.

Le trading sur marge comporte un niveau de risque élevé qui peut entraîner des pertes importantes dépassant les liquidités et/ou collatéral approuvé détenus sur le compte client.

Le trading sur marge ne convient pas à tout le monde. Veuillez-vous assurer de bien comprendre les risques encourus et demandez des conseils indépendants si nécessaire.

Saxo permet d'utiliser un pourcentage de l'investissement dans certaines actions et certains ETFs comme garantie pour les activités de trading sur marge. La valeur de garantie d'une position en actions ou en ETFs dépend de la notation de chaque action ou ETF - veuillez consulter la table de conversion ci-dessous pour plus de détails.

| Notation | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Valeur de garantie de la position | 75% | 50% | 50% | 25% | 0% | 0% |

Exemple : 75% de la valeur d'une position dans un titre ou un ETF de notation 1 peuvent être utilisés comme garantie (en lieu et place d'espèces) pour trader des produits sur marge tels que le Forex, les CFDs, les contrats à terme et les options. Veuillez noter que Saxo se réserve le droit de diminuer ou de supprimer l'utilisation d'un investissement en titres ou en ETFs comme garantie pour des positions de taille considérable ou des portefeuilles d'actions considérés comme présentant un risque très élevé.

Pour trouver la notation et la valeur de garantie, recherchez un instrument spécifique dans l'aperçu de la plateforme puis ouvrez l'aperçu du produit sélectionné. Sélectionnez le bouton d'information (i) en haut à droite, puis allez dans l'onglet Instrument.

Saxo permet qu'un pourcentage du placement dans certaines obligations soit utilisé comme garantie pour les activités de trading sur marge.

La valeur de couverture d’une position obligataire dépend de la notation de l’obligation individuelle, comme indiqué ci-dessous :

| Définition de notation* | Pourcentage de couverture |

|---|---|

| Notation la plus élevée (AAA) | 95 % |

| Notation de très haute qualité (AA) | 90 % |

| Notation de qualité (A) | 80 % |

Exemple : 80 % de la valeur boursière d'une position obligataire notée A peut être utilisée comme garantie (au lieu d'espèces) pour négocier des produits sur marge tels que des devises, des CFD ou des contrats à terme et des options.

Veuillez noter que Saxo Bank se réserve le droit de diminuer ou de supprimer l'utilisation des positions obligataires comme garantie.

Pour de plus amples informations ou pour demander la notation et le traitement des garanties d'une position obligataire spécifique ou potentielle, veuillez envoyer un e-mail à fixedincome@saxobank.com ou contacter votre chargé de compte.

Les taux de garantie varient selon les instruments et dépendent de la valeur de marché de ces derniers. Les niveaux de garantie peuvent être soumis à des plafonds réglementaires et peuvent être sujets à modification en fonction de la liquidité et de la volatilité sous-jacentes de l'instrument. C'est pourquoi les instruments les plus liquides offrent généralement des taux de garantie plus élevés.

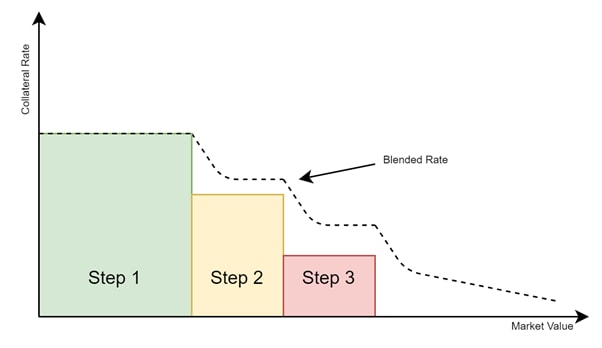

Saxo propose une méthode de garantie échelonnée comme mécanisme de gestion du risque d'écart et de liquidité. Dans le cas d'une garantie échelonnée, le taux de garantie moyen (taux de garantie mixte, ou "Blended Rate") diminue à mesure que la valeur de marché de l'instrument augmente. L'inverse est également vrai : lorsque la valeur de marché de l'instrument diminue, le taux de garantie moyen augmente. Ce concept est illustré ci-dessous :

Les différentes valeurs de marché (ou paliers) sont définies en nombre absolu de dollars américains. (USD) pour tous les instruments. Chaque instrument est assorti d'un taux de garantie spécifique à chaque palier.

Veuillez noter que le taux de garantie peut être modifié sans préavis.

Saxo se réserve le droit de réduire le taux de garantie pour les positions de taille importante, y compris pour les portefeuilles de clients considérés comme présentant un risque élevé.

Ce système repose sur les taux de garantie, où toutes les actions se voient attribuer à la fois une exigence de marge (pour les CFD et les options) et une valeur en tant que garantie.

Si l'action utilisée comme garantie est la même que l'actif sous-jacent de la position à effet de levier, une décote supplémentaire sera déduite. La « décote de concentration » supplémentaire sera égale à l'exigence de marge de la position à effet de levier.

La valeur de garantie de l'action sous-jacente sera égale à la valeur de garantie de l'action moins l'exigence de marge de la position à effet de levier.

Cela rendra l'utilisation de la marge plus sensible aux mouvements de prix de l'action sous-jacente. La décote de concentration est introduite pour tenir compte du risque accru inhérent à une position lorsque l'exposition est concentrée sur un seul actif sous-jacent et n'est pas diversifiée.

Exemple

Un client avec des taux de marge fixes souhaite acheter pour 25 000 USD de CFD dans une entreprise et possède déjà 10 000 USD d'actions dans la même entreprise. Étant donné que l'actif sous-jacent de la position CFD est le même que l'action, une décote de concentration sera appliquée. Si l'action de l'entreprise est classée 1, le calcul de l'utilisation de la marge sera le suivant:

| Portefeuille, CFD et actions sur le même sous-jacent | Valeur (USD) |

| CFDs | 25,000 |

| Actions | 10,000 |

| Exigence de marge, 10 | 2,500 |

| Décote de la garantie, 25% des actions de l'entreprise | 2,500 |

| Décote de concentration = Exigence de marge pour les CFDs | 2,500 |

| Valeur collatérale des actions après décote de concentration | 5,000 |

| Utilisation de la marge = Exigence de marge/Valeur collatérale du stock | 50% |

Si l'action sous-jacente de la position CFD était différente de l'action du client, une utilisation de la marge de 33% s'appliquerait.