Macro: It’s all about elections and keeping status quo

Markets are driven by election optimism, overshadowing growing debt and liquidity concerns. The 2024 elections loom large, but economic fundamentals and debt issues warrant cautious investment.

Head of Commodity Strategy

Summary: Diverging northern hemisphere weather patterns are playing on natural gas prices on both sides of the Atlantic divide.

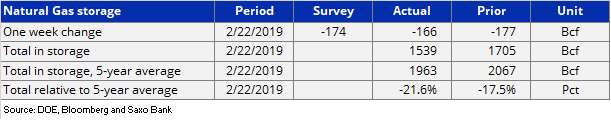

The EIA will publish its weekly stock report at 15:30 GMT today. Analysts expect a larger-than-normal inventory draw of 174 bcf, well above the five-year average of 104 bcf.