Quarterly Outlook

Q4 Outlook for Investors: Diversify like it’s 2025 – don’t fall for déjà vu

Jacob Falkencrone

Global Head of Investment Strategy

Head of Commodity Strategy

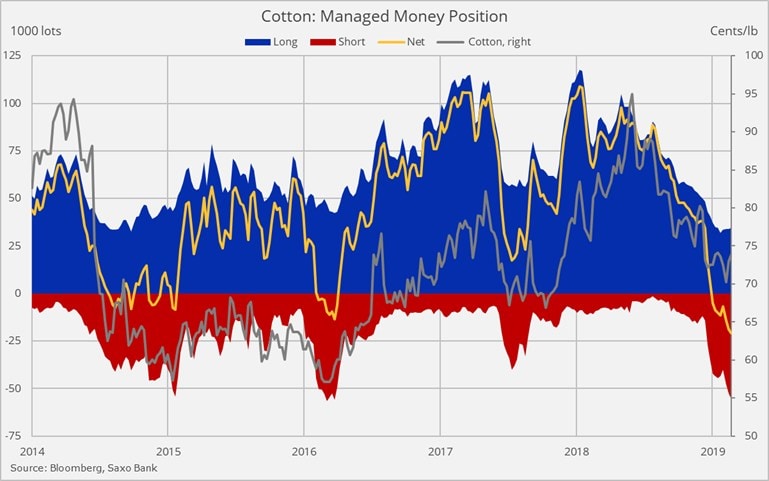

Summary: A significant speculative short-covering potential has emerged in cotton after hedge funds have driven the net-short to the highest since May 2007 following 30 weeks of selling.

Instrument: May19 Cotton option call strike 75: OCT/K19C75:icus

Price Target: 80.00 cents/lb

Market Price: 74.30 cents/lb

Entry: Buy the 75 Call on May Cotton, ticker: OCT/K19C75:icus

Stop: Use limit orders

Target: 80 cents/lb on CKZ8 (representing an intrinsic value of $2500 minus premium paid plus remaining time value)

Time Horizon: Before option expiry on April 12