Quarterly Outlook

Q1 Outlook for Traders: Five Big Questions and Three Grey Swans.

John J. Hardy

Global Head of Macro Strategy

Summary: The December 6 OPEC+ decision to maintain and deepen production cuts through the first quarter is likely to offset any potential growth concerns or renewed US-China trade worries.

Global commodities face a potentially volatile 2020, given the combination of growth concerns, geopolitical tensions, climate change and inflationary pressures. While global growth — and with that demand for key cyclical commodities — remains weak, we see the supply side also facing multiple challenges due to social unrest and climate change.

Climate change became top of mind in 2019 and we expect this focus will only continue to strengthen as the real impact is felt across the world. Whether these developments will be viewed as a temporary blip 50 years from now is irrelevant. The trend towards a warming atmosphere is likely to see weather become more volatile and unpredictable, thereby creating a challenge to global food supply chains. Already warm regions are getting hotter, while wet regions are getting wetter. 2019 was the year where several weather events ensured these developments received increased attention.

Increased weather volatility is likely to manifest itself through intense droughts, floods, heatwaves and wildfires, leading to an increase in the rate of soil loss and land degradation. At sea the change may also have a significant impact on fish and shellfish habitats and could disrupt fragile ecosystems.

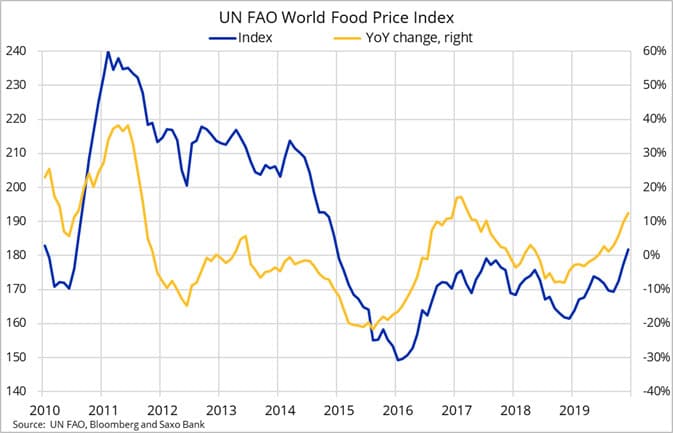

We have witnessed several years of ample supply with stable-to-lowering prices. In fact, the last period of tightness among the key crops was back in early 2010 when soaring wheat prices helped trigger the Arab Spring. While global demand and supply have both risen during the past decade, the global supply chain will be left vulnerable to a sudden weather-related drop in yields.

The World Food Price Index, published monthly by the UN FAO, rose 12.5% year-on-year in December to reach a five-year high — but still sits significantly below its 2011 peak. The index, which tracks a total of 73 food commodities across five major commodity groups, saw prices rise fastest in vegetable oils (+20%) and meat (+17%).

Ample supply and weak price action have resulted in negative returns on most exchange-traded funds with broad-based exposure to key agricultural commodities. The table below highlights three of the biggest ETFs with a diversified agriculture exposure. The chart on all three shows that the decade-long downtrend is now being challenged. Of the major commodities we see sugar, coffee, cocoa and wheat being some of the most exposed to global weather scares.

Following years of rangebound trading, we see gold further building on last year’s strong 18.5% gain. This as the technical and fundamental outlook continues to improve. However, after racing higher at the beginning of January, we may see the metal spend most of the first quarter consolidating above $1500/oz before moving higher to peak at around $1625/oz later in the year. The short-term consolidation also takes into consideration the elevated level of hedge fund positions. These have become quite extended near record levels and, in the short term, could act as a drag on price.

Geopolitical events such as the early-January US-Iran standoff supported gold but only for relatively short period of time. In order for the yellow metal to climb further, one or more of our below expectations need to be met:

Brent crude oil is likely to remain stuck in the $60s through the first half of 2020, before moving higher in the second. The December 6 OPEC+ decision to maintain and deepen production cuts through the first quarter is likely to offset any potential growth concerns or renewed US-China trade worries.

The mid-September drone attack on the world’s biggest processing plant in Saudi Arabia, the conflict in war-torn Libya and the early-January standoff between US and Iran all show just how vulnerable the global supply chain can be. However, with ample availability of strategic reserves in the US, China, Saudi Arabia and IEA countries the fallout from a disruption should be limited and relatively short-lived.

We see Brent crude oil at $75/b by year-end, as inflation picks up and the dollar weakens. Any short-term weakness, perhaps from speculators exciting speculative long positions, is likely to be limited. With continued threats to supply from the Middle East and Libya, the market is unlikely to reduce by much.