Quarterly Outlook

Q1 Outlook for Traders: Five Big Questions and Three Grey Swans.

John J. Hardy

Global Head of Macro Strategy

Anders Nysteen

Senior Quantitative Analyst, Saxo Bank

Summary: Human-generated emissions over the past 150 years most likely will persist for centuries and result in long-term changes in the climate system

The United Nation’s body for assessing science related to climate change – the Intergovernmental Panel on Climate Change (IPCC) – estimated in 2018 that human activities have caused a global temperature rise of around 1.0°C above pre-industrial levels [IPCC].

Plenty of other research groups are seeking to understand the drivers of global temperature rises by applying various climate models and simulations. The estimates of anthropogenic climate change rely on a comparison with an artificially generated model assuming the conditions of the earth without human activity. As this parallel scenario will never be realised, these climate models seek to find the best qualified guess for the parallel scenario by looking at the fundamental drivers of climate change in the past prior to human existence. As this is a difficult task, a broad variety of climate models with associated uncertainties are presented every year, all contributing to the broader climate discussion.

We do not seek to take any stance in the climate debate, but an understanding of temperature drivers is a solid basis for having a qualified view. This is also from an economic point of view, as climate change can have major geographical impacts that require a shift in agricultural production, demographical reallocations etc.

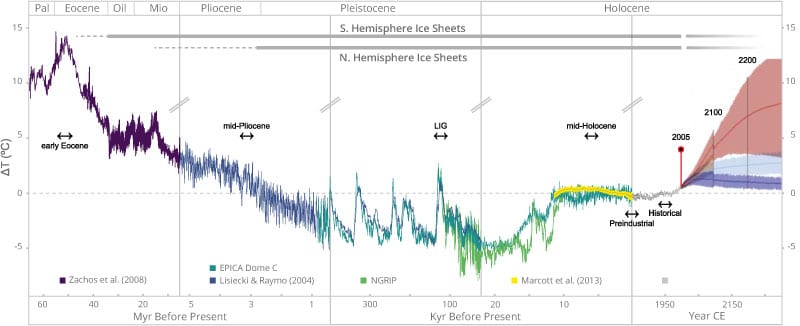

Figure 1 – Temperature trends for the past 65 million years:

The temperature of the Earth fluctuates a great deal and on a number of timescales (see Figure 1). The larger trends have been a long-term cooling from tens of millions of years before the present era in which the CO2 concentration in the atmosphere declined, and a more recent period of heating since the last Ice Age. Periodic variations in the temperature occur in cycles of 10k-100k years, driven by changes in the orbit of the Earth. These timescales are much longer compared to the changes during the past 150 years, when the global temperature has been in a rising trend. This is shown in the Berkeley Earth surface temperature project in Figures 2.

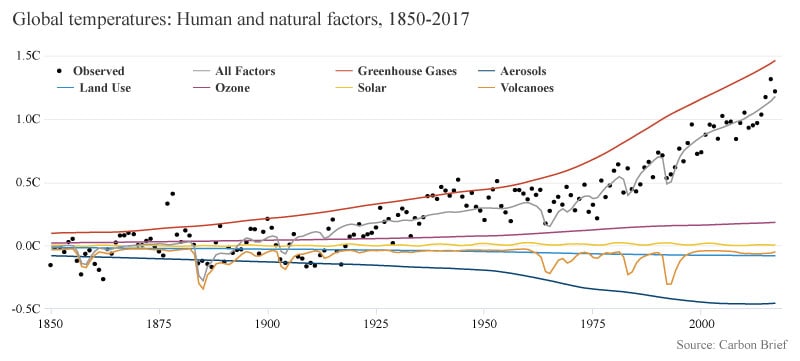

A simple climate model presented by Carbon Brief breaks down global warming since the industrial revolution into contributions from different factors as indicated in Figure 2. In a simplified overview, the major factors that will affect the Earth’s climate are:

Figure 2:

According to Carbon Brief, the human-generated impacts such as the increased greenhouse effect from CO2 and other emissions have had a major influence on rising global temperatures relative to any natural effects. This agrees with the research by IPCC, stating that human-generated emissions over the past 150 years most likely will persist for centuries and result in long-term changes in the climate system. If the present trend persists, IPCC estimates that the global temperature will rise another 0.5°C within the next 10-30 years, and the risk of a climate-related damage for natural and human systems is likely to be higher at this point than at present levels. [IPCC]

The broad variety of climate models propose many different future scenarios. Some of them contain extreme tail-risk scenarios with a very low probability of realisation. But if they are realised, they can have major social and economic impacts: causing major flooding, scarcity of food supply etc. In the end, none of these models may contain the actual scenario which is going to be realised, but it is worth keeping up to date with the newest research – even the low-probability scenarios – as risks gather that climate change makes a larger and accelerating impact on our future.

[IPCC: IPCC, 2018: Summary for Policymakers, Global Warming of 1.5°C]