Quarterly Outlook

Q3 Investor Outlook: Beyond American shores – why diversification is your strongest ally

Jacob Falkencrone

Global Head of Investment Strategy

Director of European Marketing and Education, Options Industry Council

We talk a lot about an option's price, but do we know the basic components that can help us to estimate an option's price? A quick refresher may be useful.

Although it is not the only option pricing model, the Black-Scholes formula (1973) was the first widely used model for option pricing. You can use this formula to calculate theoretical option value using the key factors listed below. While the Black-Scholes model does not perfectly describe real-world options markets, it is still often used in the valuation and trading of options.

Black and Scholes list the key determinants of an option's price as follows:

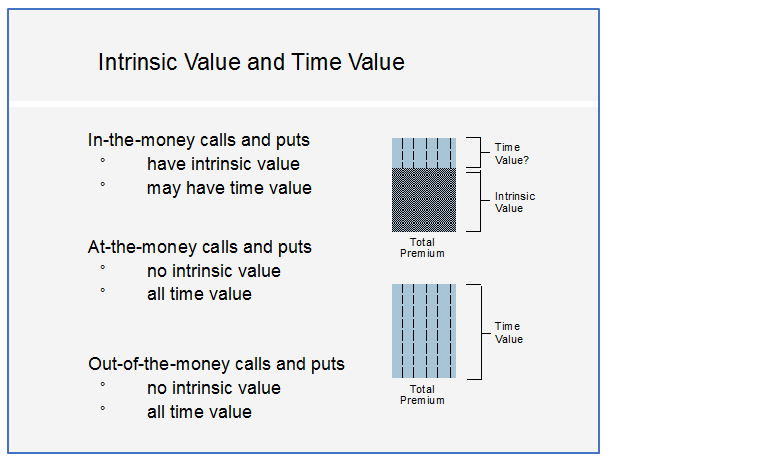

Intrinsic value and time value

The relationship between the first two components of an option's price, the price of the underlying stock and the exercise price, determines the intrinsic value of the option, which can be seen as the in-the-money portion of the option premium, or the value of the option if it is exercised now.

A call option is in-the-money if the stock price is above the exercise price. A put option is in-the-money if the stock price is below the exercise price. Out-of-the-money and at-the-money puts and calls have intrinsic value of zero (that is, they will have no value if exercised), but may still have some 'time value' as they may move into-the-money during the lifetime of the option.

Most options apart from those very close to expiry have so-called time value. In-the-money options will have intrinsic value and also time value; out-of-the-money and at-the-money options will only have time value.

Other influences being unchanged, as the value of the underlying stock rises, a call will generally become rise in value, whereas a put will become less valuable. A decrease in the value of the underlying stock will generally have the opposite effect - the call's value will fall and that of the put will rise.

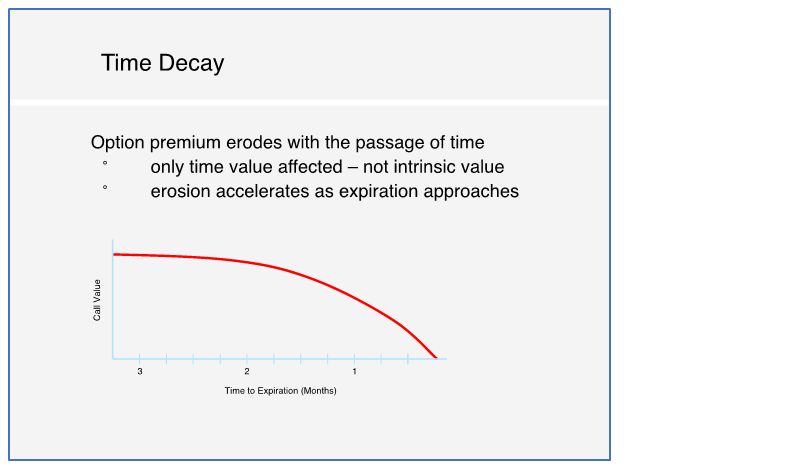

Time until expiry

The time until expiration, when the option will cease to exist, also effects the time value component of an option's premium. Generally, as expiration approaches, the level of an option's time value decay for both puts and calls.

This effect is most noticeable with at-the-money options. Note that time value typically decays more steeply as expiration approaches.

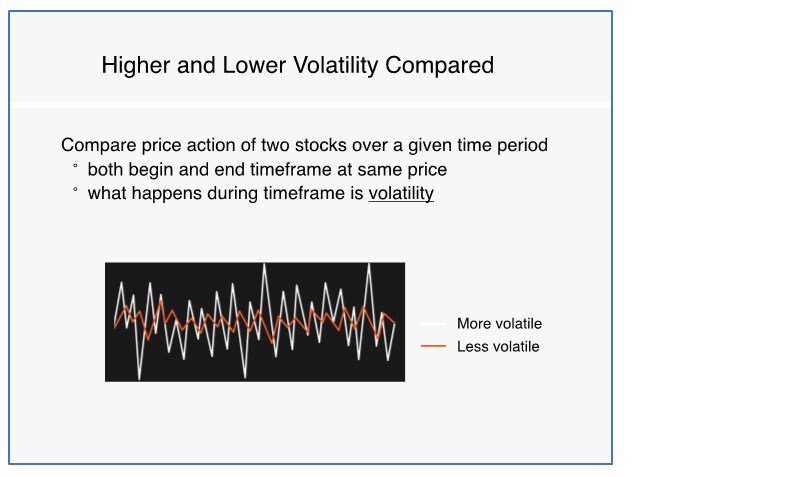

Volatility

This is probably the most discussed of the option valuation variables, because it is the most difficult to measure. Volatility is not the trend of a stock's price, but the level of fluctuation in it.

Volatility is a measure of risk (uncertainty), or variability of price of an option's underlying security. Higher volatility estimates indicate greater expected fluctuations (in either direction) in underlying price levels. This expectation generally results in higher option premiums for puts and calls alike. It is most noticeable with at-the-money options.

Volatility is hard to predict. Looking in the past, it is comparatively easy to calculate historical volatility. But, just as is the case with the underlying stock, historical performance is no guide to what may happen in the future.

Interest rates

Interest rates are historically low at the moment, but this was not always the case. Interest rates determine the cost of carry, the potential interest paid for margin or received from alternative investments (such as a Treasury bill). When interest rates are higher, their influence on an option's price is greater.

Dividends

Dividends are paid to registered holders of stock, not the holder of, say, a call option. Option pricing takes into account an option's hedged value, so ordinary dividends from stock are a factor when calculating the option's price.

After a dividend has been paid, a stock's price will fall. The ex-dividend date (ex-date) is the date on which the price reduction takes place. Investors who own the underlying stock (not those holding an option) on the ex-date will receive the dividend.

The real world

These calculations give you an estimated value or 'fair value', which will then be influenced by supply and demand in the market, so the values quoted in the market will differ from the calculated price. An option's fair value is at best an informed guess, as volatility cannot be predicted and is only calculated historically.

Market influences can actually result in highly unexpected price behaviour during the life of a given options contract. No model can reliably predict what options premiums will be available in the future, but investors can use pricing models to anticipate an option's premium under certain anticipated circumstances.

For instance, you can calculate how an option might react to an interest rate increase or a dividend distribution to help you better predict the outcomes of your options strategies...

Why option pricing models matter

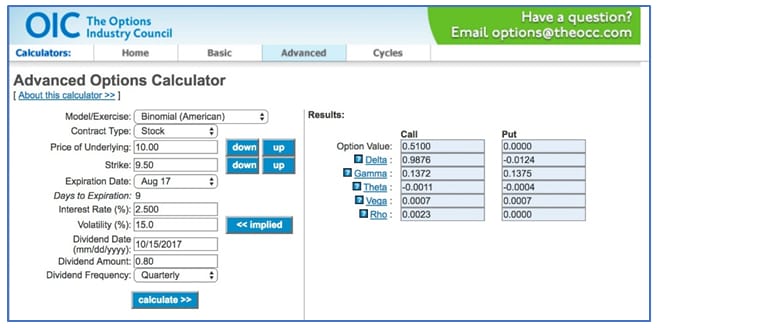

A grasp of the essentials of option pricing is useful to any option investor. Option pricing also generates the "Greeks", the measures that tell you the sensitivity of any option to changes in price (delta), volatility (vega), time (theta), and interest rates (rho).

Option prices don't hinge on just one variable. Option users should have an awareness of what can go right and what can go wrong. For example, if volatility moves sharply higher, that will make puts and calls worth more if none of the other variables have changed. Or an investor could adjust the quantities of a potential spread position and see how that change would affect the delta, gamma, and other Greeks.

Modelling tools

You can find a free option price calculator on the OIC website.

As well as being fun, using the calculator helps you understand what impact the various inputs have on an option's price. This tool shows how adjusting, for example volatility, expiration date or the underlying price can impact an option.

The Options Industry Council (OIC) and Saxo Bank

The Options Industry Council (OIC) and Saxo Bank have both invested heavily in their online education initiatives, which enable investors to increase their option knowledge and skills using easily accessible and easily digested content. For OIC's comprehensive website go to www.OptionsEducation.org and follow us; Saxo Bank's educational material can be found at https://www.home.saxo/education

About The Options Industry Council (OIC)

Celebrating its 25th anniversary, OIC is an industry resource managed and funded by OCC, the world's largest equity derivatives clearing organization. Its mission is to provide free and unbiased education to investors and financial advisors about the benefits and risks of exchange-listed equity options. OIC offers education which includes webinars, podcasts, videos, seminars, self-directed online courses, mobile tools, and live help. OIC's Roundtable is the independent governing body of the Council and is comprised of representatives from the exchanges, member brokerage firms and OCC. For more information on the educational services OIC provides for investors, visit www.OptionsEducation.org.

Disclaimer:

Options involve risk and are not suitable for all investors. Individuals should not enter into Options transactions until they have read and understood the risk disclosure document, Characteristics and Risks of Standardized Options, which may be obtained from your broker, from any exchange on which options are traded or by visiting www.OptionsEducation.org. None of the information in this post should be construed as a recommendation to buy or sell a security or to provide investment advice. ©2018 The Options Industry Council. All rights reserved.