Platform Enhancements

The following enhancements, improving your end-client experience, took place during Q1. Some of these enhancements will also be taking place early Q2.

Non-tradeable instruments

In mid-April, we will release an enhancement that indicates via a symbol if a product is non-tradable, and an explanation of why it’s not tradeable.

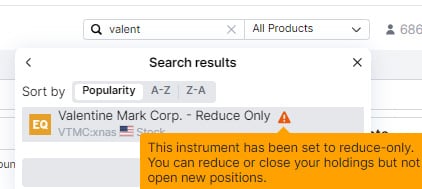

Warning in the search + Tooltip

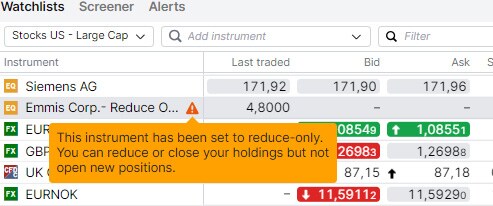

Warning in the watchlist/screener + Tooltip

Warning in the Product Page and Trade button disabled, when required (i.e. if the client has an open position, the trade button will exist, so the client can close the position. If the client doesn’t have an open position, the trade button will be disabled)

| Situation | Message | |

| NonTradableText_ReduceOnly | This instrument has been set to reduce-only. You can reduce or close your holdings but not open new positions. | |

| NonTradableText_Products_Without_KIIDs | The issuer has not provided a Key Information Document (KID) for this instrument, and we can't facilitate trading for non-professional clients. You can reduce or close your holdings, but not open new positions. | |

| NonTradableText_Offline_Tradable_Bonds | Bond is tradable offline. Contact us if you want to place an order. | |

| NonTradableText_Expired_Instrument | The instrument is now expired and cannot be traded. |

New Option Closeout Report

A new Option Closeout report will become available in April, warning clients of upcoming expiries (and potential option closeouts due to that). “Expiry” badges will be shown in different areas on the platform:

- The margin impact (current /estimated)

- The breakdown by expiry and underlying

- Estimated Option Expiry Margin: The estimated option expiry margin requirement for all options that could be in-the-money

- Weight: The weight linearly increases during the closeout risk period (two hours before option’s expiry) until it reaches 100%

- Current Option Expiry Margin = The reserved option expiry margin within the closeout period i.e. Estimated OEM x Weight

More information on the option closeout method can be found here.

Show trading hours in user’s time zone

Users can now choose whether they want to see the trading hours of an instrument in the exchange’s time zone (e.g. 9:30-16:00 EDT for US exchanges) or in their own local time zone (e.g. 13:30 – 20:00 GMT, if this is the client’s local time zone).

Analytics page uplift

Partners who subscribe to Factset and receive analytical data for stocks and stock CFDs will see an improved Analytics page in April:

Previous updates

Product Update

SaxoPartnerConnect (SPC) enhancements during Q1/Q2

Learn moreProduct Update

CMS API – potential breaking changes

Learn moreProduct Update

SaxoPartnerConnect (SPC) enhancements during Q1/Q2

Learn more