Macro: It’s all about elections and keeping status quo

Markets are driven by election optimism, overshadowing growing debt and liquidity concerns. The 2024 elections loom large, but economic fundamentals and debt issues warrant cautious investment.

Focus this session – across all asset classes – is firmly fixed on the European Central Bank's monetary policy meeting although bank chief Mario Draghi isn't expected to deliver much beyond "dovish rhetorical attempts to weaken the euro", says Peter Garnry, Saxo's head of equity strategy. "I think the biggest potential question in the press conference Q&A could be regarding the corporate sector QE purchasing programme as there are indications the ECB has already been stealthily tapering these," he adds.

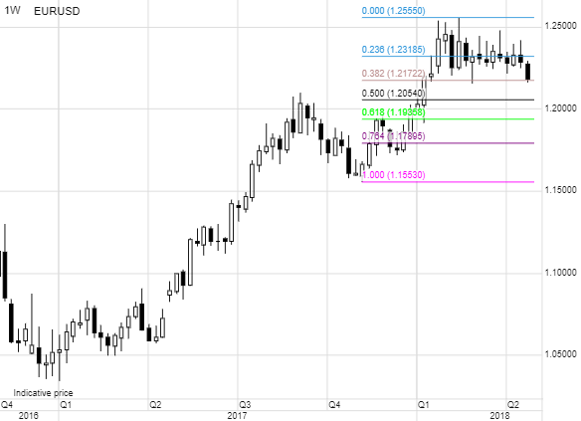

"We're also looking for Draghi's take on Europe's slowing growth momentum. The eurodollar has been persistently strong but if there ever was a time when Draghi could weaken the euro that time could be today," says Ole Hansen, Saxo's head of commodity strategy. "Technically, we're sitting right on top of an important area [see chart below] – the 1.20170 zone, the place from which we bounced the last time and it's also the 32.8% retracement level, so there'll be a lot of focus on EURUSD this afternoon," Hansen says.

Source: SaxoTraderGO

Equity markets, meanwhile, are still under pressure despite good earnings , a fact Garnry ascribes to "rising rates, macro weakness and high valuations". One of these corporate earnings reports – Facebook's – was extremely impressive with above-estimate numbers all around. But there are clouds on the horizon as the impact of the EU's new GDPR regulations will start to make itself felt in Q2.

In commodities, crude oil remains buoyant despite a bearish EIA, largely thanks to fading expectations that the US will retain its nuclear deal with Iran. "A bearish EIA inventory report briefly send oil lower yesterday before recovering after President Macron said he believed Trump will withdraw from the Iran nuclear deal" Hansen concludes.