Macro: It’s all about elections and keeping status quo

Markets are driven by election optimism, overshadowing growing debt and liquidity concerns. The 2024 elections loom large, but economic fundamentals and debt issues warrant cautious investment.

Head of FX Strategy

EM currencies generally continued to go their divergent ways at the beginning of the week, but the action later in the week showed many of them weakening, likely driven by a fresh surge in oil prices and current account considerations as well as pressure linked to rising US yields, a USD rally and a decrease in global risk appetite. Most disappointingly, a promising rally in the Mexican peso was reversed in a single brutal session this Thursday. We maintain a cautious stance on EM currencies across the board, a level of caution that has only increased due to the US dollar strength, but even more so the rise in US yields all along the yield curve. Just ahead we have a key test for the EM’s most volatile pair of currencies of late, the Turkish lira and Russian ruble, as their respective central banks are set to meet next week.

EM news and views

Below is a selection of highlighted EM movers and shakers over the last week and what may lie ahead for these selected currencies.

RUB: the ruble attempted to stabilise this week, with a generally appreciating trend amidst large intraday trading ranges. The threat of immediate further sanctions may have abated for now and a strong further rally in oil prices provided a supportive backdrop. But Russian asset prices have been slow to recover and asset managers may discount Russian assets to avoid the risks of volatility if new sanctions are implemented. The most recent round of sanctions demonstrated the kind of chaos that can be unleashed on large Russian business entities by such measures. The USDRUB floor appears much higher now, perhaps 60.00, and fresh highs for the cycle can’t be ruled out above 64.00. Next Friday the Russian Central Bank will make its policy announcement after being forced recently to halt FX purchases to avoid worsening the ruble’s slide. A more cautious signaling on further rate cuts to support the economy is a risk as shoring up stability could become more important after the recent ruble volatility.

Chart: USDRUB

USDRUB continued to settle lower over the last week, if in a nervous fashion, after the shock RUB weakening induced by the latest round of US sanctions against specific Russian oligarchs, which has thrown some of their business operations into chaos and unleashed wild moves in certain industrial metals markets like aluminium. While the risk of further sanctions appears on hold at the moment, the discount on Russian assets has been slow to recover and may not recover soon. USDRUB may risk another test higher before finding a new and higher trading range.

Source: Saxo Bank

TRY: the Turkish lira has fought back significantly from recent weakness. The currency is set for a key test in the week ahead after USDTRY recently spiked above 4.00 and EURTRY spiked above 5.00 on President Erdogan’s posturing on interfering with interest rate policy and suggesting that a significant new impulse that Turkey can ill afford is on its way. Erdogan has called for early elections on June 24. It will take a new vote for the transition to the new, more powerful office of president to take effect. How this spells TRY strength is more than a bit of a stretch, other than the thought that either Erdogan will pressure the central bank to intervene and support TRY to keep his popularity high into the snap election, or that the market somehow believes that despite Erdogan’s recent rhetoric, the central bank will go ahead and hike at next Wednesday’s meeting. Both? Structural risks to TRY without tough fiscal and monetary policy changes remain extremely high.

CNY: The Chinese renminbi is likely the world’s most important currency, due both to the size of the Chinese economy and due its egregious overvaluation and the lack of transparency on Chinese policy making. The latest signalling is that China will not pursue a devaluation. But the recent strengthening of the currency has eased since peaking in February and the brief additional strength in late March has led nowhere. This stability has also anchored the most China-exposed Asian exporters’ currencies.

MXN: the Mexican peso showed promise in recent weeks as investors brushed aside concerns centered on the July election outcome and found solace in an apparent softening of the Trump administration's tone on NAFTA. But the sudden weakening this week has thrown the peso’s rally into disarray and clouded the outlook for the bulls for now. While it has been clear for some time that the left-populist AMLO (Andrés Manuel Obrador) is favoured to win, the overwhelming strength of his support in the recent polls was still credited with affecting the peso outlook, which may have also weakened on the factors pressuring EM currencies across the board late this week (stronger USD and higher US yields). Even if we see a positive drumbeat of news on the ongoing NAFTA negotiations front, the next critical test will be the investor mood and signaling from AMLO after his victory this July 1.

INR: Big moves to the downside for the Indian rupee this week. Some credit for the sharp weakening towards the end of this week was given to the Reserve Bank of India’s rising concerns on inflation that were noted in their latest meeting minutes released this week. As well, as India is highly dependent on imported oil, the recent spike in oil prices is a powerful negative for the current account balance picture. Finally, a story circulated that Indians may be hoarding cash again after the trauma of the 2016 demonetisation, which speaks to the risk that Indians may lack faith in banks and the monetary authority – a general risk to the economy.

HKD: drama ongoing as 7.8500 band limit has been tested. Yes, we have the story of the carry trade that favours the “free ride” of earning carry as long as the USDHKD exchange rate remains stable, but it has been curious to see this trade unfolding in recent months despite a strong RMB policy from China (though it has slackened the trend). We are following this story with great interest. Does it make sense for a Hong Kong increasingly in China’s orbit to maintain a USD link?

IDR: a sharp weakening this week of not particularly large magnitude is interesting merely because the USDIDR exchange rate has appeared to “managed” of late and this is its first directional move in some time. Is this a signal that the central bank is stepping away from managing the rate or slowing/stopping further FX reserve accumulation at this time?

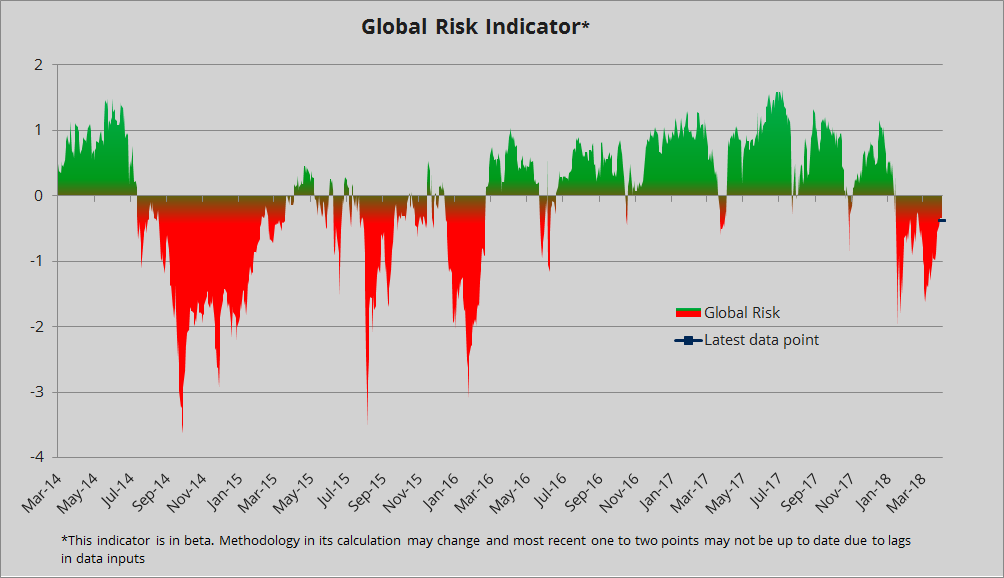

Chart: Global Risk Index – not getting worse, but can we scratch back to improvement?

Even as our concerns outlined above are actually higher this week than for the previous week, our global risk indicators is not picking up any acceleration in risk aversion. As outlined above, our key concern and the possible deal breaker for any solid return of risk appetite would be an extension higher in US bond yields, most notably the 10-year benchmark yield if it stretches above 3.0%. Next week, the US Treasury will auction well over $100 billion in 2-yr to 7-yr paper on Wednesday and Thursday.

Source: Saxo Bank

For EM specifically, our basic risk measure of broad EM sovereign credit spreads remains within the recent range, and tending towards the lower end of that range, showing there is no broad evidence of additional broad EM-linked worry at the moment, recent drama in specific EM currencies aside. The two market volatility components in our risk indicator are significant drivers of decelerating risk aversion of late, with 1-month FX volatility not far from the multi-year low of late 2017 and the VIX descending to the low end of the range since the early February volatility blow-up.

EM currency outlook: US dollar rally and US yields raise caution level

Though we continue to see a divergence in performance among EM currencies, our broad concern level has picked up this week as the latter part of the week saw a strong surge higher in US treasury yields, with the US 10-year treasury benchmark threatening to close the week near its highs weekly close at 2.90%. And this is an addition to a rather sharp new acceleration of late in the shorter US yields to new highs for the cycle as leading US indicators and Fed rhetoric have the market pricing in higher odds of three additional rate hikes this year. If Fed expectations continue to stretch to new highs and the US 10-year yield stretches beyond the pivotal 3.00% level that has implications stretching all the way back to 2014, this would likely weigh on risk appetite and emerging market assets as well.

Another risk dogging global markets are the further threat of US sanctions on Russia if the latter takes up a defiant stance. Somewhat linked to that, is the pivotal question looming of whether Iran sanctions will be reinstated on May 12 by the Trump administration and the geopolitical and oil-price mischief this might unleash. Finally, the US sanctions against China have not yet taken effect and we have a nervous wait until the late May deadline of the “consideration period”.

Elsewhere, the more commodity exposed EM currencies, like COP and CLP and PEN, have done well in recent weeks and may continue to outperform other EMs if commodity prices (for these three currencies, most important are oil for COP, copper for CLP, and copper and gold for PEN) continue to rise – with sanctions real and feared helping to boost some key commodity prices at the moment. On the flip side, if trade war worries ebb and economic growth worries make their return (we are expecting the latter in coming quarters), commodity linked currencies could suddenly find themselves at the bottom of the heap.

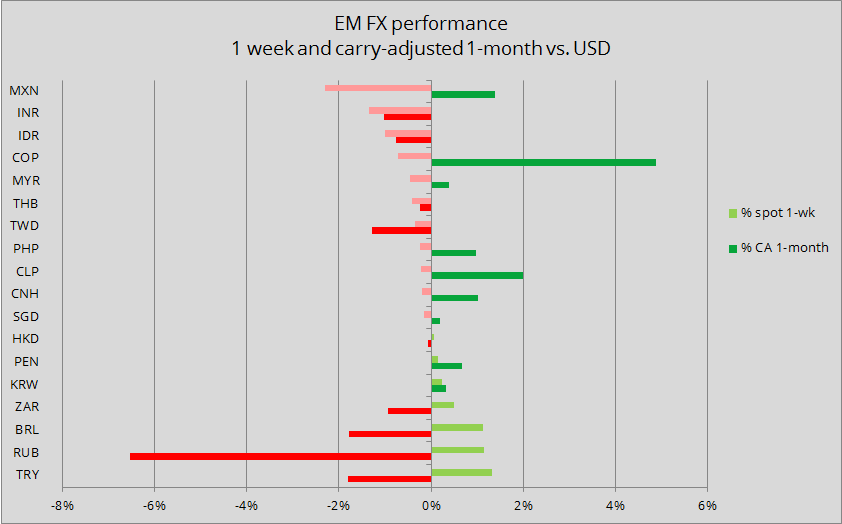

EM currency performance: Recent and longer term, carry adjusted

Chart: the weekly spot and 1-month carry-adjusted EM FX returns vs USD. RUB and TRY performance over the last 1-week and 1-month require a bit of rubbing of the eyes when looking at the chart below – strongest over the last week, but only because of bounces from very weak performance in the weeks prior (especially in the ruble’s case). Meanwhile, the peso finds itself at the bottom of the 1-week performance rankings after this week’s knee-buckling weakening on Thursday in the wake of the latest presidential election polls.

Source: Saxo Bank

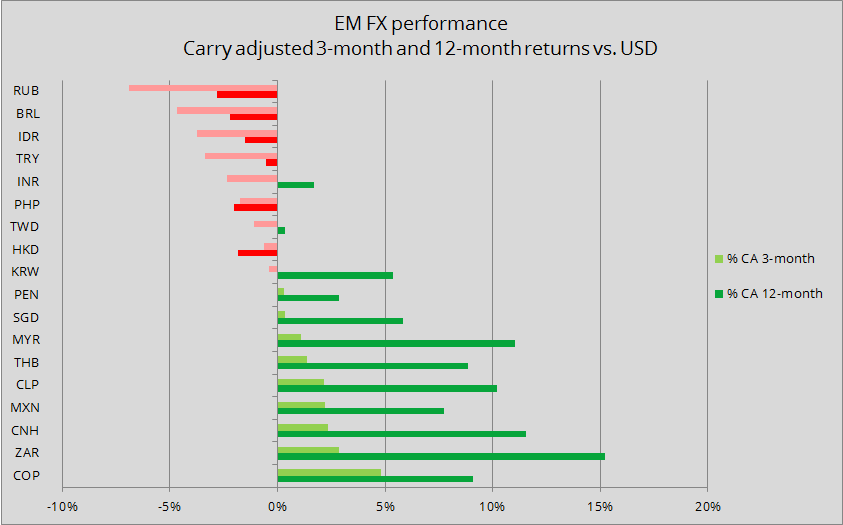

Chart: 3-month and 12-month carry-adjusted EM FX returns vs USD. The chief observation for the longer term is that most of the positive performers versus the USD saw their salad days prior to the last three months, where the going has been rockier. The real slipped another slot while among the positive performers over the last twelve months, most are either commodity linked or linked to China (KRW, THB, MYR, SGD), which has pursued a strong CNY policy over the past twelve months.

Source: Saxo Bank