Macro: It’s all about elections and keeping status quo

Markets are driven by election optimism, overshadowing growing debt and liquidity concerns. The 2024 elections loom large, but economic fundamentals and debt issues warrant cautious investment.

Head of Commodity Strategy

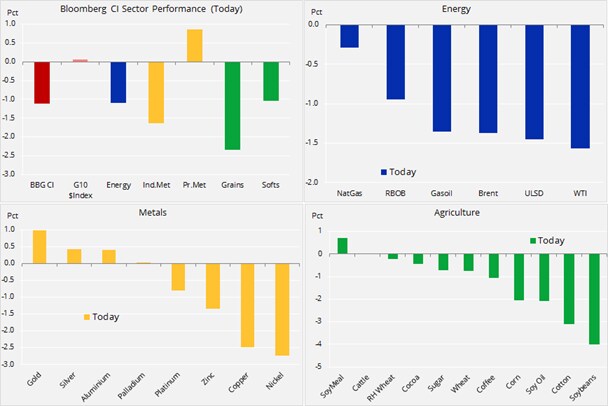

Commodities are trading lower after China earlier today published a list of 106 U.S. goods worth a combined $50 billion that are going to be subject to a 25% additional import tax. This followed the White House announcement yesterday of 25% tariffs on $50 billion of annual imports from China, covering about 1,300 products ranging from industrial technology to transport and medical products.

The response from China included a wide range of U.S. goods including soybeans and other agriculture products, as well as items from cars to chemicals and whiskey, cigars and tobacco.

The announcement triggered heavy selling in global stock market indices with an escalating trade war potentially impacting growth and demand. Growth worries hit cyclical commodities such as oil and industrial metals while gold received a renewed safe-haven bid. Hardest hit, however, is the agriculture sector with key crops such as soybeans, corn and cotton being hurt the most.

U.S. soybeans futures slumped on the news as it put at risk a trade with China, the world's biggest buyer of U.S. soybeans, worth about $14 billion last year. Once the dust settles it is very unlikely that the U.S. and China can live without each other with other major exporters especially in South America not being able to meet Chinese demand.

A great deal of speculative length in soybeans and corn has been caught offside today. Not least after traders bought both crops after last Thursday's prospective planting report showed that U.S. farmers would plant less soybeans and corn than previously expected.

The energy sector has also been hit and just like corn and soybeans, the biggest damage has been done by bullish traders being caught on the wrong side of the market. WTI and not least Brent crude oil saw heavy buying during the past couple of weeks as traders turned their attention to the potential risk of supply disruptions from Venezuela and Iran.

The technical outlook had already deteriorated after Monday's sharp sell-off helped confirm the creation of a double top in both crude oil contracts. We maintain the view that both crude oil contracts are currently range-bound with no clear direction deriving from the current themes.

In the short term, however, the rejection at the January high could see WTI crude oil retrace towards trend-line support at $60/b. US stocks are well down ahead of the US opening and on that basis, a recovery into the US session is likely to support the market.

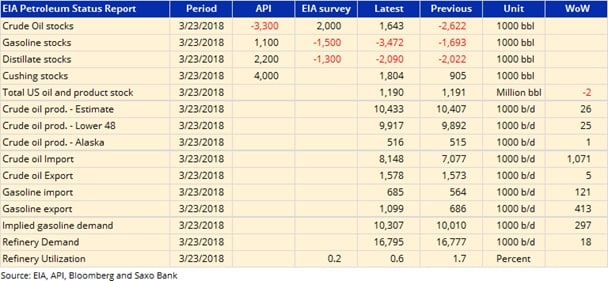

Next up we have the weekly inventory report from the EIA at 14:30 GMT. Given the focus today on China vs the U.S. and the stock market gyrations this report could potentially turn out to be a non-event. Not least after the API report last night managed to create a great deal of confusion with oil and product stocks all moving against current surveys.