Balanced ETF portfolios USD Q2 2021 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | 2.4% |

| Moderate | 4.6% |

| Aggressive | 5.6% |

Market overview

Similar to the 1st quarter, the 2nd one was characterized by strong economic data. However, after solid performance of risky assets at the beginning of the year, markets have been more muted in the second quarter. In addition, positive data surprises have raised concerns about inflation which could push central banks to lower monetary support and thereby weight on the economic rebound.

The UK and US were leading in terms of positive economic releases – driven by high inoculation rates and fiscal support. The pace of recovery for the European Union has stepped up in Q2 and asset prices benefited. However, in the emerging parts of the world, where vaccination levels are substantially lower, such as in Asia, we have seen new virus outbreaks and lockdowns.

Not surprisingly, on the equity side, year to date, developed markets reported the highest returns led by Europe, North America and Japan. This was driven by a massive vaccine rollout and strong fiscal and monetary measures. Value and size factor have largely benefitted from these dynamics. The emerging markets, specifically Asia, still returned positively but certainly more muted. The recent increase in infections is part of the story but we should also not forget that these markets posted the strongest quarterly returns over a decade at the end of last year. More recently, China equity has seen a correction which started in February on the back of concerns about policy tightening.

The fixed income markets were clearly influenced by the increase in inflation and, thereby, the fear of tighter monetary policy in the near future. Year to date, government bonds have performed negatively across the board. Climbing up the risk ladder, investment grade still suffered while high yield, as a result of its correlation to equity, managed to post positive returns. Separately, interest rate linked fixed income securities posted low positive returns.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| Apr | 1.2% | 2.5% | 3.1% |

| May | 0.7% | 1.1% | 1.4% |

| June | 0.6% | 1.0% | 1.0% |

| Since Inception (Feb 2017) | 21.4% | 38.6% | 52.2% |

The multi asset portfolios all produced positive returns in Q2 and YTD, outperforming their respective index benchmarks.

Broadly speaking, the overweight to equities continues to pay off as the asset class performed strongly. In absolute terms, all equity positions contributed positively led by the US and followed by emerging markets and Europe. From a relative standpoint, since the April rebalance, the overweight to the US, Canada and the emerging markets has contributed. However, an underweight in Europe was a key performance detractor.

The fixed income allocations reflect the general market observations. In absolute terms, contributions were mostly negative with the exception of high yield and interest hedged credit. Long-dated US treasuries were the largest detracting force although the underweight to duration has helped shielding some of that off.

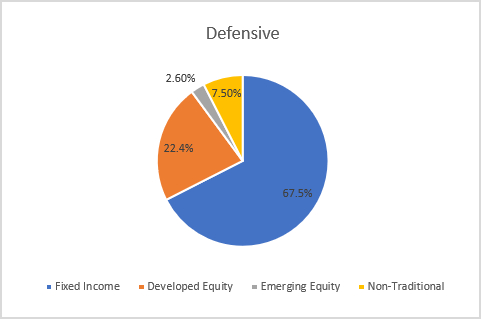

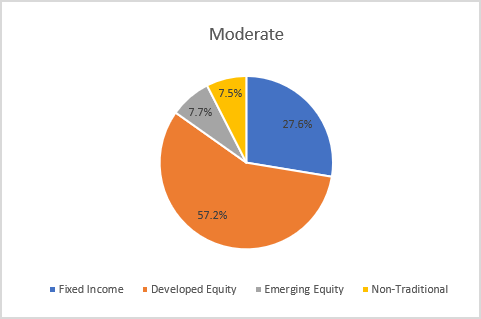

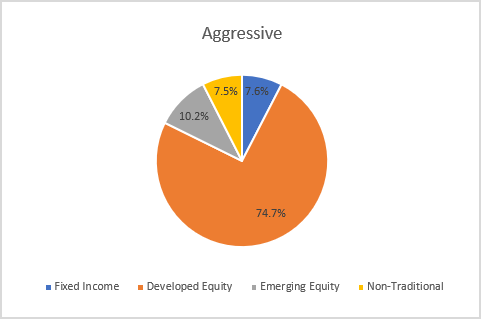

Portfolio Allocation and top portfolio holdings (as of June 2021)

Outlook

The BlackRock team (the “team”) remains optimistic on equity and further increases the equity overweight by funding it from US high yield.

Within the equity sleeve, the team is constructive on EMU as valuation and management sentiment improved. Vaccination rate in major European countries are picking up and improved optimism on a stronger economic recovery. The overweight in Canada is increased because of the country’s exposure to Energy, which is likely to benefit from higher inflation expectation. Also, Canada has made significant progress in vaccinations over the past few weeks. As a result, the share of population that received at least one vaccine dose has surpassed that in UK and US.

Emerging market equity, US minimum volatility and Pacific ex Japan are the major funding sources for the increase in EMU and Canada. Valuation continued to deteriorate in the emerging markets. It has been lagging in vaccination rates, thereby making it vulnerable to new COVID infection waves and slower economic recovery. Economies in developed markets are expanding on recovery and the Fed’s target zone of low and modest inflation at an average of 2% dimmed performance of minimum volatility.

Within the fixed income sleeve, the underweight in duration is kept at the portfolio level. US high yield has outperformed the fixed income benchmark and the team is taking profit from the previous overweight as spreads narrowed to the lowest levels in 10 years. The team is moving some of the previous high yield allocation to equity and emerging market fixed income for a higher carry.

The allocation within the alternative sleeve for all three risk profiles is maintained.