Balanced ETF portfolios SGD Q1 2021 commentary

| Asset classes | Stocks (developed and emerging equity), bonds, non-traditional |

| Instruments | ETFs |

| Investment style | Macro, diversified investment focus |

| Quarterly return (net of fees) | |

| Defensive | 0.51% |

| Moderate | 3.91% |

| Aggressive | 5.53% |

Market overview

The year of 2020 ended on a strong footing with equity markets recording solid gains. Much of that was a result of improving sentiment based on news about effective vaccines, a followed inoculation drive that started in early 2021, and well-coordinated recovery measures by governments across the globe. The remainder of the first quarter did not disappoint.

After the Democrat victory in Georgia, the US launched yet another impressive stimulus package. Combined with a strong vaccine rollout in the US and UK, investors are hoping for a sustainable reopening of the economy. As a result, sentiment remained positive - equity markets and commodities reflected that by good performance while treasury yields rose in sync.

On the equity side, developed markets reported the highest returns led by Japan, Europe and the US. This was partly driven by the vaccine rollout but also a generally higher demand in goods as reflected by expanding manufacturing. Financials have benefitted the most given higher yield and steeper curves while growth stocks have suffered as a result. Value and size factor have largely benefitted from these dynamics. Emerging markets and Asia posted lower but positive returns in Q1, taking a breather after a stellar year and the strongest quarterly returns over a decade in Q4 2020. This was predominantly driven by the selloff in Chinese equities in February while the recent strengthening of the US Dollar also played its role.

Looking at fixed income, there are concerns that the mentioned positive drivers, in combination, could lead to an increase in inflation and thereby a tighter monetary policy in the near future. However, the Federal Reserve in the US has voiced out that it does not expect to raise rates before 2024. Yet, that fear is reflected in bond yields where government bonds and investment grade credit suffered the most and posted negative returns. The riskier high yield names, as a result of its correlation to equity, managed to close the quarter with low single digit returns.

Portfolio performance

| Returns net of fees | Defensive | Moderate | Aggressive |

| Jan | -0.17% | 0.15% | 0.33% |

| Feb | -0.80% | 0.91% | 1.59% |

| Mar | 1.49% | 2.82% | 3.54% |

| 2020 | 6.41% | 7.41% | 7.49% |

| Since Inception (Jan 2017) | 13.4% | 24.3% | 35.9% |

The moderate and aggressive portfolios produced positive returns in Q1, while the defensive portfolio posted a negative performance. Broadly speaking, our overweight to equities has paid off as the asset class performed strongly. In absolute terms, all equity positions contributed positively led by US equity and followed by emerging markets and Europe. From a relative standpoint, since the February rebalance, our overweight to Europe and the US has contributed positively while the overweight in EM and underweight to the UK has detracted.

The fixed income allocations reflect the general market observations. In absolute terms, contributions were mainly negative with the exception of high yield and interest hedged credit. Long-dated US treasuries were the largest detracting force although our underweight to duration has helped shielding some of that off.

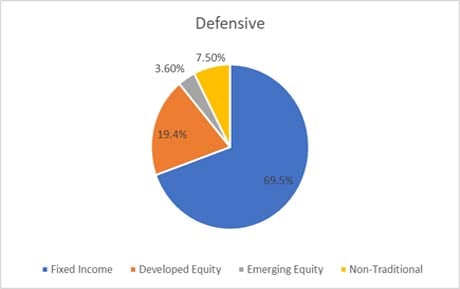

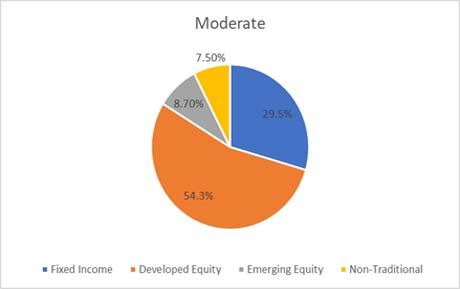

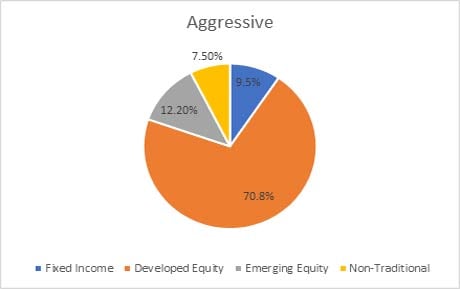

Portfolio Allocation and top portfolio holdings (as of 16 Apr 2021)

Outlook

The investment management team (the “investment team” or the “team”) remains optimistic on equity and maintain the equity overweight in the Multi-Asset portfolios.

Within the Equity sleeve, the team underweights EMU because of deteriorated valuations and rather weak earnings momentum. The vaccination rate in EMU is lower than the UK and US which is likely to delay the recovery in the region compared to other markets. On the other hand, the team trimmed the underweight to UK to neutral given the higher inoculation rate. The investment team also added allocation to Japan as valuations improved. Exposures such as UK and Canada have a generally higher allocation to Financials and Energy and therefore benefit from increasing inflation expectation.

The team maintained the overweight to the US as valuation and earnings momentum continued to improve. Allocations to emerging markets are also maintained to provide a diversification benefit to the overall portfolio.

Within the fixed income sleeve, the team maintains the current duration at portfolio level, which is about 0.3 to 0.5 years less compared to the index benchmark across different risk profiles. The team is adding to high yield as spread momentum continued to be positive, mainly funded from credit. The team trimmed the underweight to mortgages to achieve a better balance of portfolio risk.

The investment team keeps the allocation within the alternative sleeve for all three risk profiles for diversification purposes.